- Uber has made an offer to buy food delivery company Grubhub, a person familiar with the matter told CNBC Tuesday.

- Grubhub’s stock spiked as much as 38% on Tuesday following an initial report from Bloomberg that Uber approached Grubhub with a takeover offer.

- If Uber and Grubhub were to combine, it would bring together two of the largest food delivery companies and increase competition with other companies like DoorDash and Postmates.

Uber has made an offer to buy food delivery company Grubhub, according to people familiar with the matter.

The two companies have had discussions about an all-stock deal that would offer Grubhub shareholders 2.15 Uber shares for each Grubhub share, one of the people said. The people requested anonymity because the information is confidential.

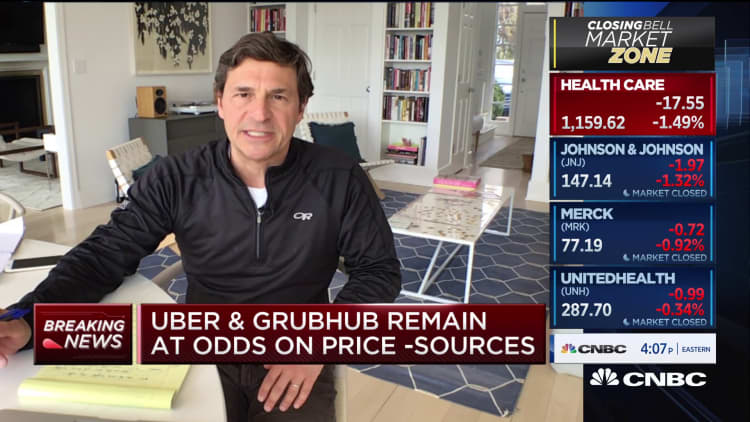

However, both sides have yet to agree on a deal, and CNBC’s David Faber reported Tuesday that Uber has rejected the proposal to buy Grubhub for 2.15 Uber shares per share of Grubhub. The two sides have been in acquisition talks off and on for about a year, Faber reported. The two sides remain at odds on price.

Grubhub had a market cap of about $5.8 billion Tuesday afternoon, after news of a potential deal sent Grubhub’s stock skyrocketing up as much as 38%, before ending the day up 29%.

Uber’s stock was up nearly 4% on Tuesday afternoon, bringing its market cap to about $56.8 billion. It ended the day up 2.4%.

In a statement to CNBC, Grubhub did not confirm Uber’s offer, but said that it would continue looking at “value-enhancing opportunities” and that consolidation “makes sense” in the food delivery industry.

“We remain squarely focused on delivering shareholder value,” Grubhub said in the statement. “As we have consistently said, consolidation could make sense in our industry, and, like any responsible company, we are always looking at value-enhancing opportunities. That said, we remain confident in our current strategy and our recent initiatives to support restaurants in this challenging environment.”

In its own statement, Uber also did not confirm it made an offer to acquire Grubhub.

“We are constantly looking at ways to provide more value to our customers, across all of the businesses we operate,” Uber said in the statement. “We have shown ourselves to be disciplined with capital and we do not respond to speculative M&A premiums.”

Earlier this year, Grubhub issued a statement denying it was for sale, after reports that it was an acquisition target from a few grocery companies, including Walmart. The company said at the time that “there is unequivocally no process in place to sell the company and there are currently no plans to do so.”

Uber has a rapidly growing delivery business called Uber Eats, and it was the one bright spot in the company’s last earnings report as its core ride-hailing business fell drastically due to the coronavirus pandemic. However, Uber Eats’ growth was not enough to offset the downturn in Uber’s rides business, and the company posted a whopping net loss of $2.9 billion for the first quarter.

Uber announced last week that it would lay off 3,700 employees, or about 14% of its workforce, due to the downturn in its business caused by the pandemic.

If Uber and Grubhub merge, it would join two of the largest food delivery companies into one. Other food delivery rivals include DoorDash and Postmates. Uber previously held merger talks with DoorDash, but the talks went nowhere, according to a person familiar with the matter.

Last week, Uber led a $170 million investment in scooter company Lime, which resulted in an integration of the two companies’ products. As part of the deal, Uber handed over its own scooter and bike business, called Jump, to Lime. The Lime and Uber apps will eventually integrate.