- Layoffs at small business spiked 1,021% in March, compared to the month before, according to payroll provider Gusto.

- April is expected to be much worse with economists forecasting unemployment at as much as 15% or more.

As the economy craters, small businesses are among the hardest hit.

When unemployment claims began to jump nationwide in March, layoffs among small business spiked 1,021% compared to the month before, according to exclusive data compiled by human resource provider Gusto, based on more than 100,000 small businesses nationwide.

“This is unprecedented,” said Daniel Sternberg, the head of data science at Gusto.

Following a decade of job growth, small businesses quickly resorted to layoffs, furloughs and slashed employee hours in order to survive the economic fallout from COVID-19.

Overall, headcount among small businesses fell by 3.7% in March, according to Gusto.

“That’s 4% fewer people employed in one month,” Sternberg said — the equivalent of more than 2 million people.

More from Personal Finance:

How to handle your loss of income

Coronavirus and your 401(k): Some make these money moves

Five things for your to-do list if you think your job is in danger

During this time, small businesses in New York, particularly those that rely on foot traffic, notched the highest net loss of employees, followed by Nebraska and New Mexico, Gusto found.

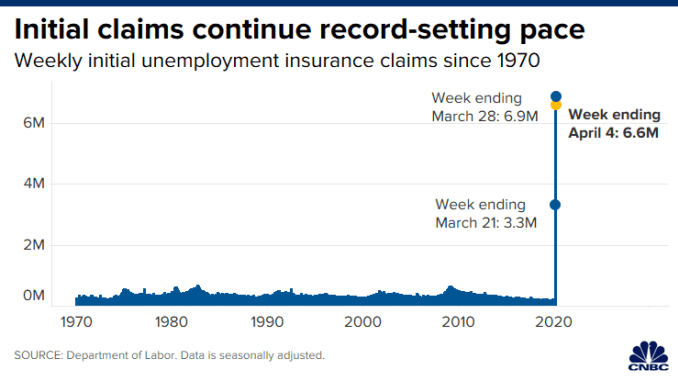

April is expected to be much worse with economists forecasting unemployment at as much as 15% or more.

Overall, small businesses employ roughly 59 million people in the U.S., according to the Small Business Administration. However, few have much in the way of a financial cushion in case of emergency.

Now, half of all small businesses said they will not be able operate beyond three months without relief aid, according to a recent survey by Goldman Sachs.

“There is a lot of stimulus out there already,” said Tomer London, Gusto’s co-founder. “The key is to get those dollars in the hands of small businesses.”

Gusto’s data is based on their own customers, which are primarily small businesses with 100 employees or less. Typically, Gusto handles the bulk of what a human resources department would do — from payroll to benefits administration. Now they are also providing clients with the additional payroll information they need to supply to lenders in order to qualify for the Paycheck Protection Program.