Bank of England says higher interest rates are yet to hit many homes but lenders are proving resilient.

Image source, EPA

Image source, EPAMortgage payments will rise by at least £500 a month for nearly one million households by the end of 2026, the Bank of England has said.

Households and firms have been under pressure as interest rates have risen in a bid to lower high inflation.

In a report, the Bank said mortgage holders “may struggle with repayments” on loans.

But it said lenders are strong enough to withstand a rise in customers defaulting on repayments.

The Bank has raised interest rates from 0.1% in December 2021 to 5% to curb rising prices.

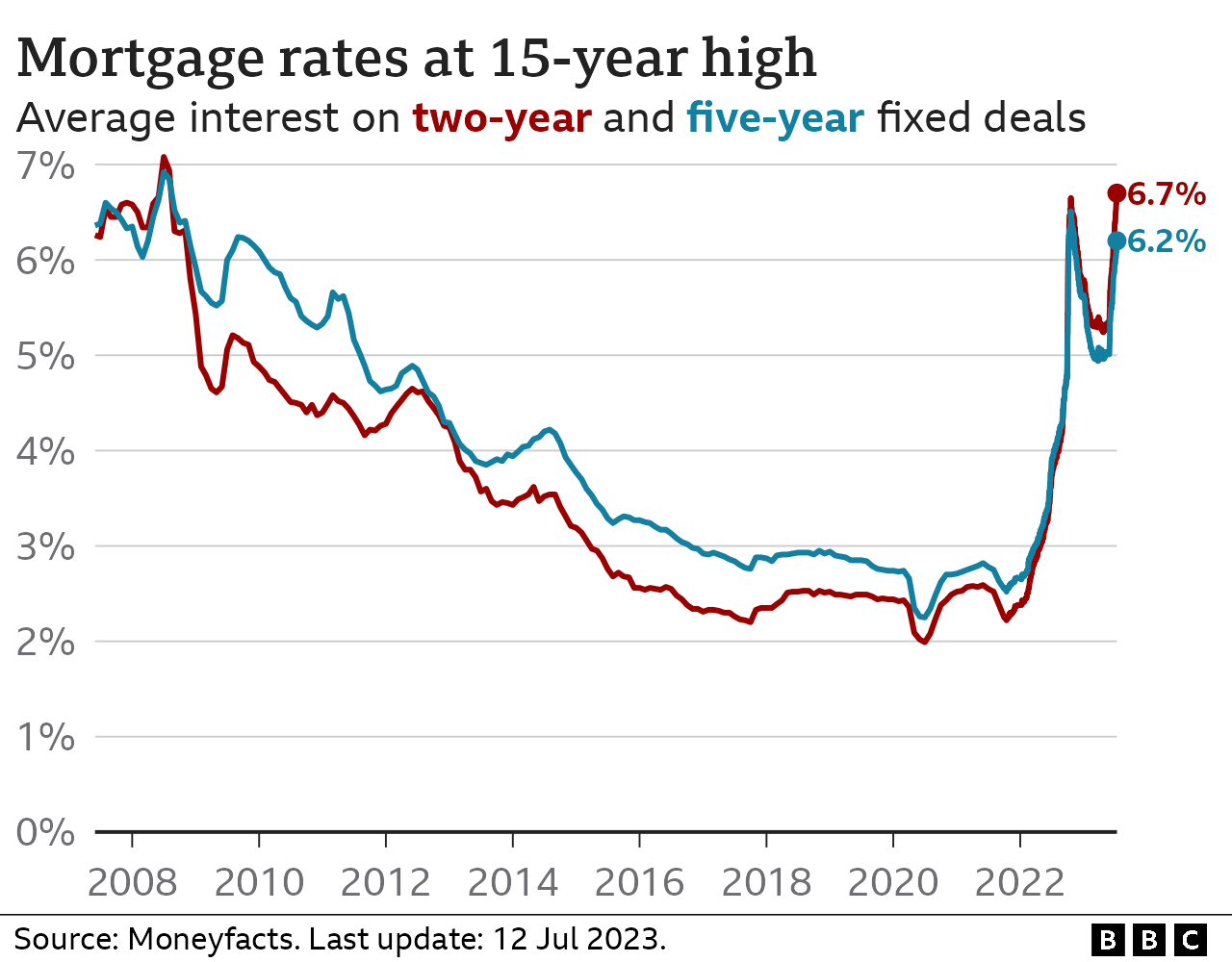

Expectations that borrowing costs might rise even further has pushed up mortgage rates. On Wednesday, the average rate on a two-year fixed mortgage hit a fresh 15 year high of 6.7%, according to Moneyfacts, the financial information service.

The Bank of England said in its twice-yearly Financial Stability Report that as fixed-rate mortgage deals expire and people renew their loans, mortgage repayments will go up.

More than two million households will pay between £200 and £499 more per month over the next three and a half years, it warned.

A further one million mortgage holders will see their monthly payments rise by at least £500.

In the shorter term, the average household coming off a fixed rate deal in the second half of 2023 will have to pay about £220 more a month if they refinanced at current rates.

Craig Johnston, 38, from Sheffield, told BBC News that his mortgage would effectively double from £679 per month in 2021 to £1,209 from the end of September.

It means he will have to make sacrifices “across the board” in terms of what he can spend – and what he can save.

“It’s not great,” Mr Johnston. “I’m not particularly happy about it at all. I’d rather the money be in my pocket rather than someone else’s pocket.”

He said he was unsure how raising rates is helping people.

“For all of us – homeowners, taxpayers, people paying rent – I just don’t see how it’s going to be better,” he said, adding: “It just seems to be like ‘put the interest rates up and we’ll see what happens’. I don’t get the logic.”

Image source, Sara Khan

In Scotland, GP Sara Khan feels “let down” by the Bank of England as she has watched repayments on her tracker mortgage rise from £1,600 to more than £2,000 a month.

She and her husband and their four young children, aged between 11 and four, live “pay check to pay check” she told the BBC. But because they are considered “financially stable” they are not eligible for any support.

“I’m educated, so is my husband but what about other people. There are these professionals who are supposed to guide us, they need to get this sorted. I do feel let down.

“The Bank of England looks like someone who’s blindfolded trying to do something and hoping it will sort itself out. Well, it’s not,” she said.

The Chancellor of the Exchequer, Jeremy Hunt, said in June that the Bank has “no alternative” but to raise rates.

The theory is that raising rates makes it more expensive for people to borrow and that they will have less money to spend. They buy fewer things which slows the rate of rising prices.

Most mortgages taken out in recent years have been at a fixed rate of two or five years which means there is a lag in terms of when recent rate rises will hit households.

About 4.5 million homes have had to pay more in mortgage repayments since late 2021, and higher rates will hit the vast majority of the rest by the end of 2026.

Higher rates mean households and firms cut back on spending, “worsening the economic environment, and increases the risk that they will default on loans”, the Bank said.

However, banks have to support households having difficulty with repayments, reducing the risk of defaults, the bank said.

Stricter lending rules since 2014 have also helped by limiting the amount of mortgage debt, the Bank said.

Andrew Bailey, Governor of the Bank of England, said a “much stronger” employment market was “helping a lot in terms of the stress that households are seeing”.

The rate of UK unemployment has ticked higher but at 4% remains relatively low.

But he added that wage rises, which are linked to a strong labour market, are helping to keep inflation high.

The Bank of England said that “although the proportion of income that UK households overall spend on mortgage payments is expected to rise”, it expects it to remain below peaks seen during the global financial crisis and in the early 1990s.

It added: “UK banks are in a strong position to support customers who are facing payment difficulties. This should mean lower defaults than in previous periods in which borrowers have been under pressure.”

It said that, so far, the UK has been “resilient” to rapidly rising interest rates.

On Tuesday, Barclays group chief executive C. S. Venkatakrishnan said the effects of higher interest rates have been “more benign” than in the 1990s, when hundreds of thousands of homes were repossessed by lenders.

“First of all, people have jobs,” he said. “Second, people are finding value for money – they are managing their finances well, and they are controlling their spending.”

“Third, the banks are committed to helping people who might believe they might have difficulty meeting their mortgages,” he said, including short payment holidays.

The Bank of England’s report also showed the result of a “stress test” on the UK’s eight biggest banks and building societies to see if they could withstand catastrophic economic conditions.

These include house prices falling by 31%, the unemployment rate increasing to 8.5% and inflation rising to 17%.

The banks and building societies that have been tested include: Barclays, Lloyds, HSBC, NatWest, Santander UK, Standard Chartered, Nationwide Building Society and Virgin Money.

These eight banks account for 75% of lending in the UK.

How is your mortgage affected by rising interest rates? How are rising mortgage costs changing how you live your life? You can share your experiences by emailing haveyoursay@bbc.co.uk.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can’t see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk. Please include your name, age and location with any submission.

What should I do if I miss a mortgage payment?

- A shortfall equivalent to two or more months’ repayments means you are officially in arrears

- Your lender must then treat you fairly by considering any requests about changing how you pay, perhaps with lower repayments for a short period

- Any arrangement you come to will be reflected on your credit file – affecting your ability to borrow money in the future