The average monthly mortgage bill will go up from £750 to £1,000, the Bank of England says.

Image source, Getty Images

Image source, Getty ImagesAbout four million UK households will face higher mortgage payments next year, the Bank of England has said, with the typical payment up by £250.

The average monthly mortgage bill would go up from £750 to £1,000, the Bank’s Financial Stability Report said.

The rising cost would cause severe financial difficulties for another 220,000 households, the Bank said.

Businesses would also be under “significant pressure” owing to rising prices and borrowing costs, it added.

“Falling real incomes, increase in mortgage costs and higher unemployment will place significant pressure on household finances and weigh on their ability to service debt,” Bank of England governor Andrew Bailey said in a letter to the Treasury.

The Bank also warned of an increased danger of global financial risks. However, it said that households, businesses and banks were more resilient than before the global financial crisis of 2008 and the recession of the 1990s.

Fixed-rate mortgage deals have a set interest rate during the term of the deal. Most run for two or five years, but longer deals are available.

Anyone coming to the end of their fixed-rate deal and looking for a new one, or first-time buyers taking out their first mortgage, have seen these loans become much more expensive than they had probably expected or planned for.

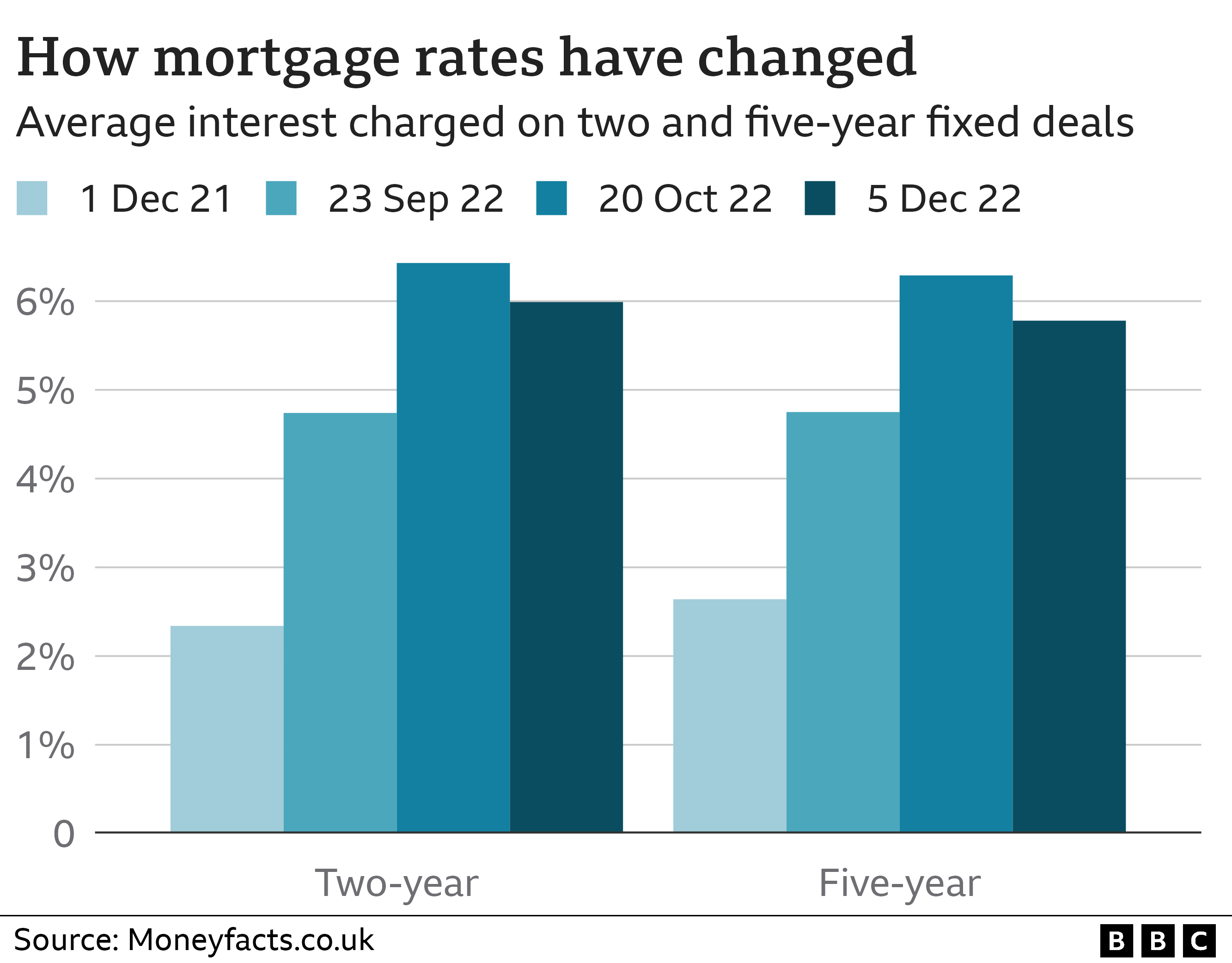

Rates on new fixed-rate deals have climbed throughout this year, as the Bank put up interest rates to fight inflation, but they shot up following the mini-budget, peaking at 6.65%.

However, they stabilised then fell slightly in the run-up to, and after, Chancellor Jeremy Hunt’s Autumn Statement which calmed the markets and, in turn, eased uncertainty for lenders and borrowers.

Variable or tracker rate mortgages can change at any time, usually in response to decisions made by the Bank’s Monetary Policy Committee on the benchmark Bank rate.

Through the different forms of home loan, an estimated four million households would see their mortgage costs rise next year, the Bank said.

A further two million would see higher costs by 2025, adding to headwinds facing the housing market. Within three years, 70% of mortgage holders would see their payments increase.

Meanwhile, property prices have fallen for three months, the sharpest downturn since the global financial crisis more than a decade ago.

The Bank said buy-to-let investors were particularly vulnerable, as about 85% of mortgages to landlords were interest only, making them highly sensitive to rising borrowing costs.

It warned that landlords would either raise rents for tenants or sell off their properties, causing a deeper fall in house prices.

“Were landlords to seek to offset the projected rise in buy-to-let mortgage costs, it was estimated they would need to increase their rental income by around 20%,” the Bank’s report said. “This would increase the cost of housing for renters.”