The business secretary blames market turmoil on the UK’s failure to raise interest rates fast enough.

This video can not be played

To play this video you need to enable JavaScript in your browser.

Jacob Rees-Mogg’s claims recent economic turmoil is not linked to the mini-budget have been criticised.

The business secretary said market volatility could be due to the Bank of England’s failure to raise interest rates in line with the US.

“It’s much more to do with interest rates than it is do with a minor part of fiscal policy,” he told the BBC.

Economists and some MPs said huge tax cut plans without explaining the economic impact had worried investors.

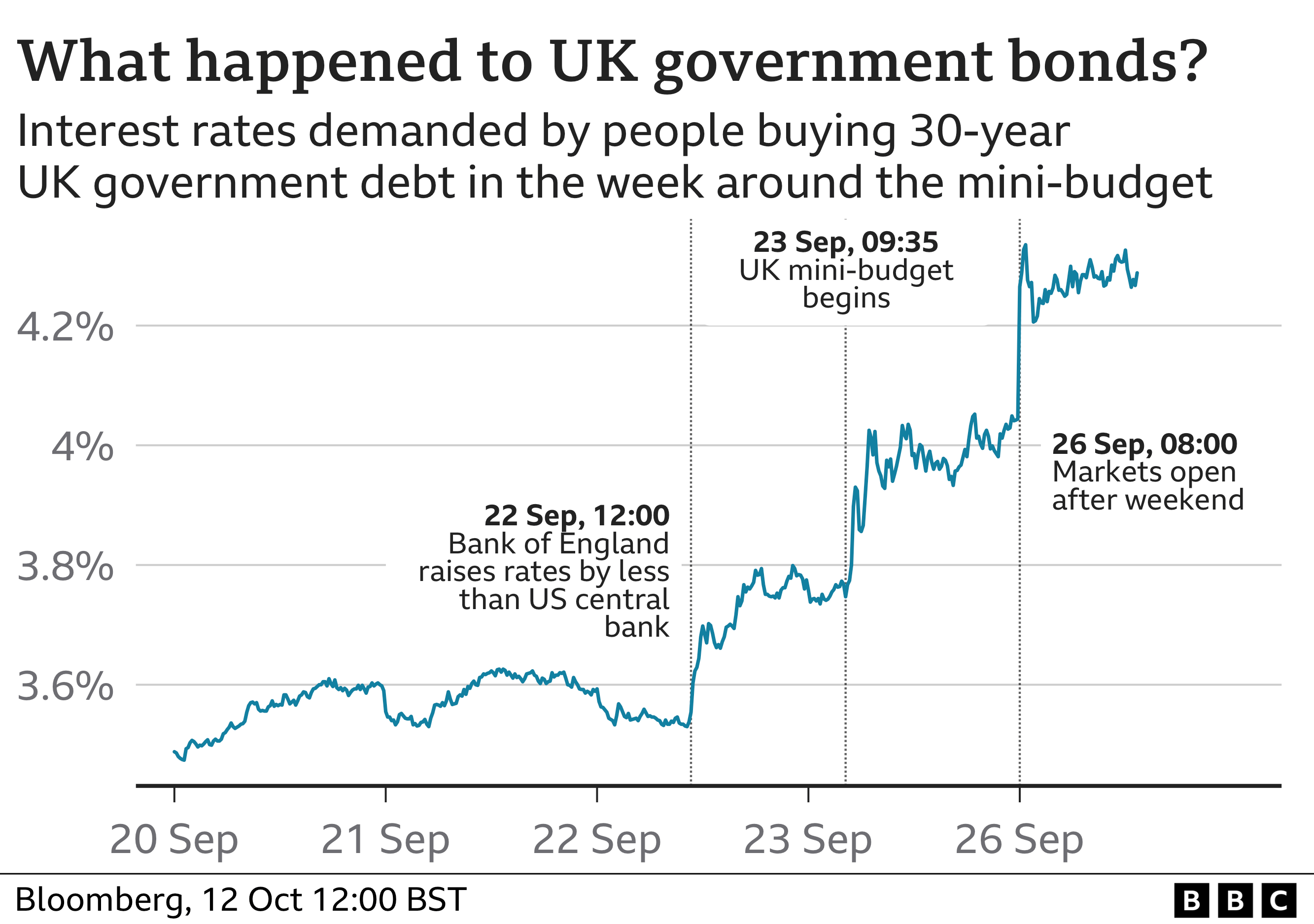

After the mini-budget, the pound plunged and government borrowing costs surged.

“What has caused the effect in pension funds… is not necessarily the mini-budget. It could just as easily be the fact that the day before the Bank of England did not raise interest rates as much as the (US) Federal Reserve did,” he said.

“Jumping to conclusions about causality is not meeting the BBC’s requirement for impartiality” he said, after a suggestion the chancellor’s actions had been the trigger for the fluctuations in the value of the pound and government bonds.

At the first PMQs since the mini-budget, Labour leader Sir Keir Starmer accused Prime Minister Liz Truss of “ducking the question” when asked whether she agreed with the business secretary.

Ms Truss said the government had taken “decisive action”, adding “as a result of our action… we will see higher growth and lower inflation.”

‘Straw that broke camel’s back’

Deutsche Bank’s chief UK economist Sanjay Raja told MPs the mini-budget on 23 September was the “straw that broke the camel’s back”.

He said the “trade shock” because of Brexit is a factor, and added: “You throw on the 23 September event, you’ve got a side-lined financial watchdog, you’ve got lack of a medium-term fiscal plan, one of the largest unfunded tax cuts we’ve seen since the early 1970s, it was kind of the straw that broke the camel’s back.”

The Resolution Foundation’s Torsten Bell said it was clear the huge package of cuts, which was downgraded to £43bn after Mr Kwarteng’s U-turn on the top rate of income tax, should not have happened in the current financial climate.

He also said the sacking of the Treasury’s top civil servant Sir Tom Scholar had contributed.

“Yes, firing Treasury civil servants isn’t a good idea, that hasn’t helped, side-lining your fiscal watchdog hasn’t helped,” he told the MPs.

Image source, Getty Images

He added that after Chancellor Kwasi Kwarteng announced a plan that “dumped fiscal orthodoxy”, then vowed to bring forward further tax cuts, it was “no surprise to any of us that this is where you end up”.

“This is what happens if you aren’t paying attention,” he said. “It was always going to be hard but it was exactly because it was always going to be hard that you don’t do this.”

Head of Multi Asset at Royal London Asset Management, Trevor Greetham, told the BBC that the risk of a recession has increased because of the market turmoil, which he said he believed was linked to the mini-budget.

“There is frustration that hard-won credibility for the UK market has been lost,” he added.

“And if you read some of the commentary from overseas, it is pretty damning at the moment.”

Professor Jagjit Chadha, director of National Institute of Economic and Social Research (Niesr) agreed that the market turmoil was a result of the “undermining” of the “cooperative arrangement” between UK’s leading financial institutions.

Should governments announce major tax cuts again without consulting the UK’s top financial bodies, Professor Chadha warned that a “succession of higher interest rates and higher deficits” would result.

Professor Chadha told the Commons Treasury Committee that the “real danger” seen after the mini-budget was “obviously on the back of what can only be described as guerrilla tactics against our independent economic institutions over the summer – the Treasury, the Bank of England and the Office for Budget Responsibility”.

Gerard Lyons, an economist who advised Liz Truss and Kwasi Kwarteng during the leadership contest, speaking on the BBC’s World at One programme admitted that the mini-budget “misread” the country’s financial situation.

However, he argued that everything that has happened was not “solely due to the mini-budget” but also down to parts of the financial system that were vulnerable to interest rates going up.

The Bank of England has warned interest rates could rise again after the value of the pound plummeted, following the government’s decision to cut taxes and borrow more.

After the market turmoil, it stepped in with an emergency bond-buying intervention designed to stabilise the economy but said this scheme would end on Friday.

Prime Minister Liz Truss has said the promised tax cuts will boost UK economic growth and therefore help pay for themselves.

The chancellor has also committed to publishing an independent forecast of the UK’s economic prospects by the OBR, the independent budget watchdog, at the same time as his economic plan – something he declined to do with his mini-budget.

Meanwhile, the UK economy unexpectedly shrank by 0.3% in August, according to new figures from the Office for National Statistics.