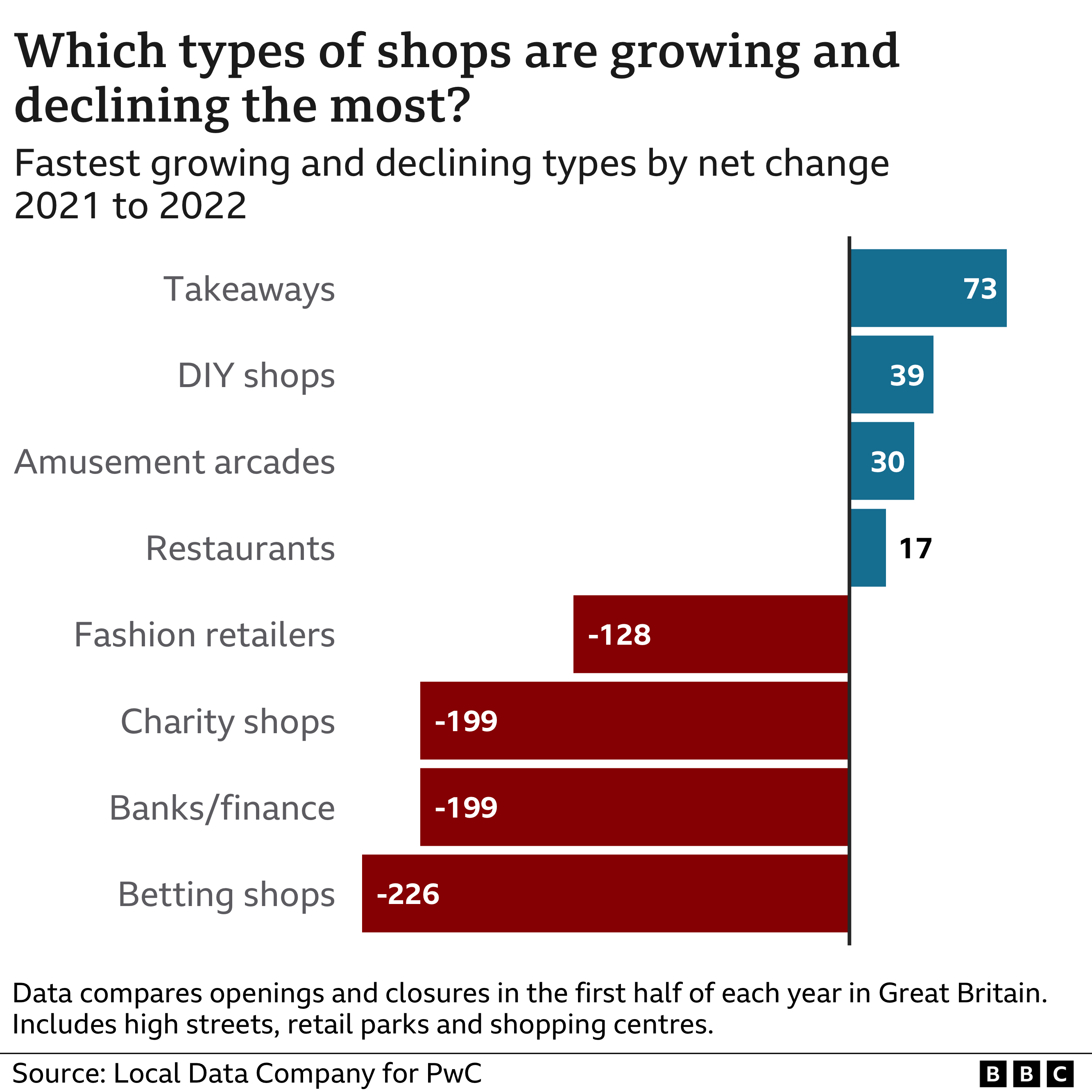

Betting shops and banks are in decline but the restaurant sector is growing, new data suggests.

Image source, Getty Images

Image source, Getty ImagesThere has been a big fall in the number of chain stores shutting across Britain, new figures show.

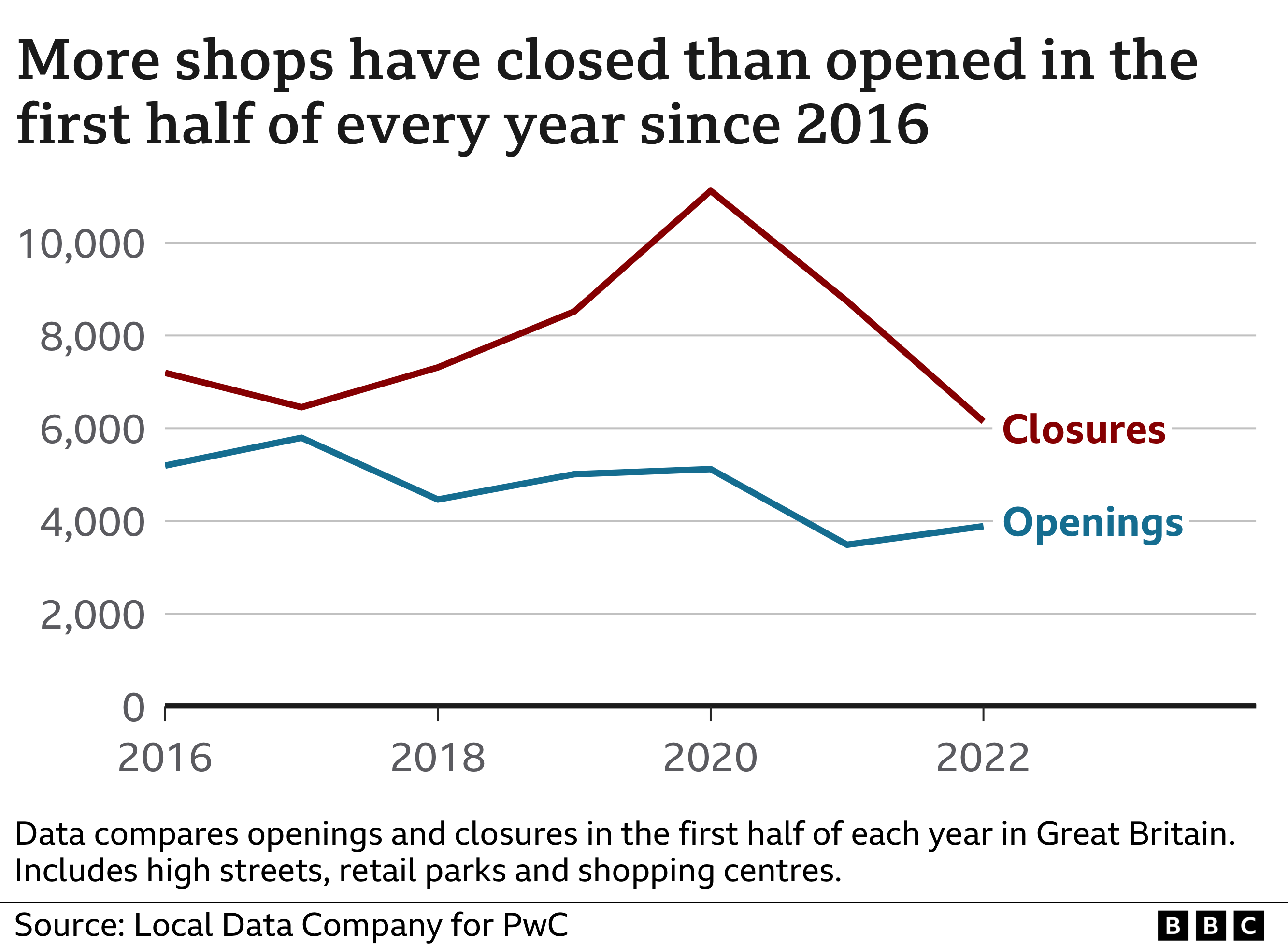

Closures in the first six months of the year dropped by a third compared with the first half of last year, accountancy firm PwC said.

Shop openings are still below pre-Covid levels, but closures are now at their lowest level for seven years.

PwC said the shock of the pandemic had “eased”, but warned that high inflation will hit the retail sector.

The firm produced the research in partnership with the Local Data Company (LDC), which tracks over 3,000 locations, including High Streets, retail parks and shopping centres in England, Wales and Scotland.

“The good news is that we’re back on High Streets, there are more people out shopping and eating,” said Kien Tan, director of retail strategy at PwC.

“But the bad news is inflation hangs over us. It will affect shoppers in their pocket. But it will also affect businesses in terms of higher bills to pay. So there could be more closures to come,” said Mr Tan.

For now though, the figures are heading in the right direction.

The analysis covers businesses with more than five outlets and includes everything from retail and hospitality to gyms, banks and hairdressers. It does not include independent traders.

More than 6,000 stores closed in the first half of this year, but the numbers are sharply down on the previous 12 months.

Store openings are still lacklustre and below pre-pandemic levels, resulting in an overall loss of more than 2,200 outlets. That is an average closure rate of 12 stores a day, although it is the smallest number of net closures in five years.

Lucy Stainton, commercial director at the LDC, said the trends seen were “hugely varied”.

“Although it has been over two years since the start of the pandemic, we are still yet to define our ‘new normal’ which is having a sustained impact on city centre locations, with many new openings being focused on smaller market towns and local High Streets as people continue to work from home.

“City centres are further hampered by both train strikes and airport travel disruption reducing tourist numbers,” she added.

The types of closures is changing, too.

In the first half of last year, more than 1,000 clothing shops disappeared as the pandemic pushed a wave of big names, like Philip Green’s Arcadia group, over the edge. This time round, it is betting shops, banks and charity shops that are declining the most.

“Our High Streets are still changing quite dramatically and they will continue to evolve. Banking and betting can all be done online. Restaurant chains are actually back in growth for the first time in five years and that’s because we can’t replace that kind of eating and drinking at home,” said PwC’s Mr Tan.

‘A great opportunity’

Nick Collins, chief executive of hospitality business Loungers, says changes in the property market are helping his company expand.

The firm was founded in 2002 and has two brands, Cosy Club and Lounge, offering all-day cafe-bar and restaurant dining.

It now has 203 sites across England and Wales and its latest outlet opened in Canterbury three weeks ago, replacing a home and haberdashery shop.

“We’ve been looking at the city for four or five years. And we’re really pleased to be open,” Mr Collins says.

As retailers have moved out, he has been seizing the chance to move in, nabbing sites he would not have had a chance of securing a decade ago. And the rents are usually better, too.

“As banks and retailers like Dorothy Perkins have come out of the High Street, these units are prime pitch locations right in the centre of the High Street, benefiting from strong footfall going past all day and through the evening. That’s giving leisure operators like us a great opportunity.”

Image source, Loungers

The business has gone from strength to strength, he says, and hopes to open around 30 sites this year in smaller, regional locations.

But do the economics still stack up, given the “cost-of-doing business” crisis facing the sector? Potentially ruinous energy bills and a collapse in discretionary spending could make this a bleak midwinter.

He says that Loungers is “well set” to weather the economic storm. For instance, the company has long-term hedging contracts for energy in place for its existing sites until 2024.

But he is fearful for other less well-capitalised firms.

“It’s a very, very challenging time to be operating in the leisure sector at the moment. Most operators have seen a four, five-fold increase in their energy costs. And for many businesses, they won’t be able to survive that. “