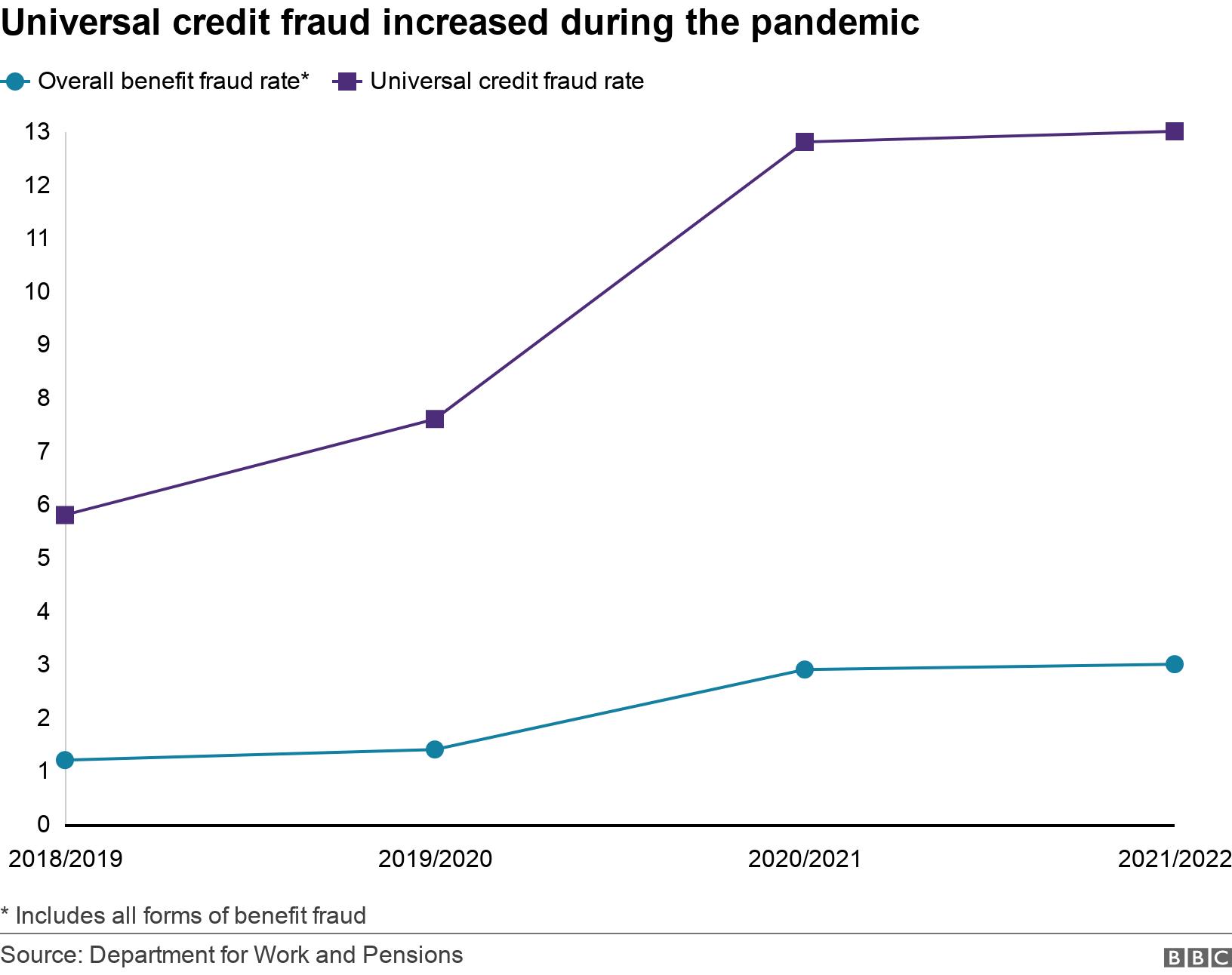

About 13% of universal credit claims were fraudulent, compared with 3% for all benefits.

Image source, Getty Images

Universal credit fraud hit a record high of 13% in the year to April 2022, costing the taxpayer more than £5bn.

It marks an increase of almost three-quarters on pre-pandemic fraud levels, and a slight rise on the previous year.

From the start of the pandemic, the government eased certain conditions to allow unprecedented numbers of people to access financial help.

Fraud levels across all benefits were 3%, which the Department for Work and Pensions (DWP) said was “unacceptable”.

The DWP statistics show one in four claims for universal credit was overpaid – either because of error or fraud.

Total spending on benefits in 2021-22 went up by 2.1% or £4.1bn, mainly because of a rise in the number of universal credit claimants, and an inflation-linked increase to the payments.

Universal credit is the main benefit payment for working-age people. It was introduced to replace a range of different benefits for those who are unemployed or low-paid, in a bid to make the system simpler.

It’s claimed by more than 5.8 million people in England, Scotland and Wales, 40% of whom are in work.

Claimants received an extra £20 per week from April 2020 to October 2021.

Universal credit fraud was already rising before the pandemic started. But an unprecedented spike in applications at the beginning of lockdown in 2020 meant some benefit rules were relaxed to ensure that people were paid quickly. This in turn led to widespread fraud, including by organised crime groups.

In December 2021, the DWP announced it was to spend more than £500m over the next three years tackling fraud, including hiring about 2,000 fraud investigators.

Earlier this month, the DWP set itself a target of cutting £2bn in fraud over the next three years. Part of these plans include forcing banks to share more data with the department, for instance to check if a claimant’s savings are too large to qualify for benefits.

“It’s unacceptable to see that fraud rose as a result of callous criminals exploiting measures to help those in need during the pandemic. Our new fraud plan will root these crooks out of the system, while protecting it from new threats in the future,” a DWP spokesperson said of the newly released figures.

Last November, a group of MPs said that while they could understand why the DWP had chosen to relax the rules, “the amount of taxpayers’ money being lost is simply unacceptable”.