Stock futures held steady in overnight trading on Monday after the market scored its best day in six weeks on rising optimism about a coronavirus vaccine.

Futures on the Dow Jones Industrial Average rose about 20 points, while the S&P 500 futures were flat. The Nasdaq 100 futures were also little changed.

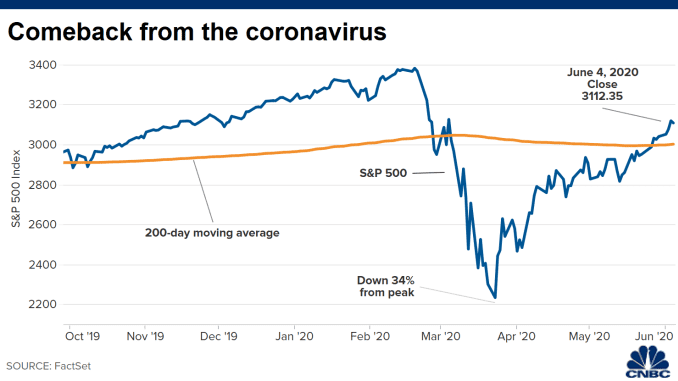

The overnight action followed a strong rally on Wall Street that saw the Dow and S&P 500 both enjoying their biggest one-day gains since April 6. Investors cheered news that an experimental coronavirus vaccine from Moderna showed promising early signs. The 30-stock Dow jumped more than 900 points, while the S&P 500 closed the day up 3.2%, hit its highest level since March 6.

Stocks that would benefit from a reopening of the economy led the market higher on Monday. Cruise operator Carnival gained 15.2%, while Delta and United Airlines both popped more than 13%.

“With over 100 treatments and vaccines under development, a medical breakthrough, a more sophisticated test and trace model, and government support could drive more upside,” Mark Haefele, chief investment officer at UBS Global Wealth Management. “But our downside scenario cannot be ruled out. This could be triggered by a significant second wave of virus cases breaking out.”

With Monday’s gains, the S&P 500 has rebounded 32% from its March 23 low, now sitting about 13% below its record high in February.

On Tuesday, Federal Reserve Chairman Jerome Powell and Treasury Secretary Steven Mnuchin will testify virtually before the Senate Committee on Banking, Housing, and Urban Affairs in the first required update to Congress on the economic response to the coronavirus pandemic.

Powell is expected to reiterate the central bank’s commitment to using its “full range of tools” aimed at keeping markets functioning and getting money to those in need.

Originally published on CNBC.com