- The Paycheck Protection Program offers small businesses access to a forgivable loan in order to cover payroll expenses over the course of eight weeks.

- After a number of publicly held firms qualified for the program, Treasury said these and other companies with “adequate sources of liquidity” have until May 7 to repay the loan in full.

- The Treasury then announced it would give companies another week – May 14 – to return the proceeds if they don’t need the funding.

Business owners who received loans through the Paycheck Protection Program and don’t need it have until May 14 to return the cash.

The PPP – a forgivable loan program that allows small businesses to cover up to eight weeks of payroll costs, mortgage interest and other expenses – was just refilled to the tune of $310 billion on April 27.

Since then, approximately 2.2 million loans have been made to applicants, adding up to more than $175 billion, according to the Small Business Administration.

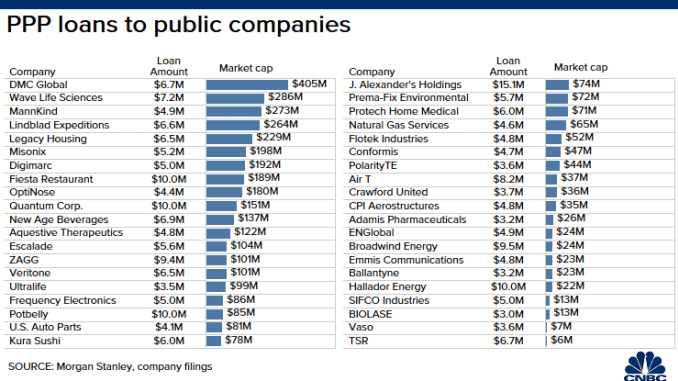

Small businesses aren’t the only ones who participated, however. Shake Shack, Ruth’s Chris Steak House and Potbelly, as well as other large companies, received funding.

Though Shake Shack, Ruth’s Chris and Potbelly later returned the money, amid public outrage, many others said they’d keep it.

This prompted Treasury and the SBA to issue a clarification in a set of “frequently asked questions,” giving businesses up until May 7 to return the funding or else face government scrutiny, potential fines and more.

On Tuesday night, the agencies granted borrowers still more time to return the cash, extending the deadline to May 14.

“The SBA came out and said that if you had liquidity, if you were a publicly traded company with access to capital markets – you shouldn’t have gotten the loans and you made a false certification to the lender,” said Tony Nitti, CPA and partner at RubinBrown in Denver.

Not just public companies

The Treasury’s FAQ didn’t just single out companies with access to capital markets.

Private companies with “adequate sources of liquidity to support the business’s ongoing operations” must also consider whether they really needed the PPP loan and should return the money.

Small businesses and CPAs assisting them are still uncertain on what “adequate sources of liquidity” means.

“The thing that’s got them concerned is what does it mean by ‘access to capital,’” said Greg Zbylut, a tax attorney at Breyer Andrew in Burbank, California. “Do I have to tap into my savings to pay my employees for an indefinite period of time and then get the loan?”

Even attorneys and accountants are at loggerheads on how to interpret the guidance and advise entrepreneurs.

“Good luck from a legal perspective arguing that someone has made a false certification when the CARES Act — the legislation that established the PPP — only says you need to certify that you need the money due to economic conditions,” Nitti said.

Indeed, a business that’s fine right now could encounter rockier times as the economy worsens.

Nitti said he recently spoke with a client who was trying to decide whether to return the PPP funds. Though the calculations seemed to suggest the business was fine in the present, two major customers are running into trouble.

“So the dark times are probably ahead,” Nitti said. “Why give this money back? When he took the loan, his business looked solid, but he could be in dire straits in three weeks.”

Best course of action

For now, professionals are telling small business owners to maintain detailed records detailing how they use the money and prepare for the possibility of further scrutiny.

“We’ve been telling people that when they get the funding, they need to go to the bank and open a separate account,” said Dan Herron, CPA and principal at Elemental Wealth Advisors in San Luis Obispo, California.

“If you’re a sole proprietor, every time you make a transfer, write down what it’s for,” he said.