Prices continue to rise much faster than expected, with UK inflation remaining at 8.7% in May.

Image source, Getty Images

Image source, Getty ImagesInterest rates are expected to rise again after UK inflation remained stuck at a much higher level than expected for the fourth month in a row.

Inflation, which tracks prices rises, was 8.7% in May, the same as in April.

The shock figure was driven by higher prices for flights and second-hand cars but supermarket food prices also continued to rise rapidly.

Interest rates are widely expected to rise by 0.25% to 4.75% on Thursday but some suggest they could now rise to 5%.

Karen Ward, a member of chancellor Jeremy Hunt’s economic advisory council, said the Bank had “been too hesitant” in its interest rate rises so far and called on it to “create a recession” to curb soaring prices,

“It’s only when companies feel nervous about the future that they will think ‘Well, maybe I won’t put through that price rise’, or workers, when they’re a little bit less confident about their job, think ‘Oh, I won’t push my boss for that higher pay,'” she told the BBC’s Today programme.

But Andrew Selley, chief executive of Bidfood UK, a wholesale food supplier said increasing interest rates was “not the right thing to do”.

“It’s stifling the economy. They need to look at other ways to support businesses so they can weather the storm,” he said.

Mr Hunt appeared to back further interest rate rises saying it would not “hesitate in our resolve to support the Bank of England as it seeks to squeeze inflation out of our economy.”

The Bank is tasked with keeping inflation at 2% but the current inflation rate is four times higher than this. It has been steadily raising interest rates since the end of 2021. This makes it more expensive to borrow money and theoretically encourages people to borrow less and spend less, meaning price rises should ease.

This has led to concerns over loans, particularly mortgages, with homeowners – a third of adults in the UK – facing large increases in repayments when fixed-term deals come to an end. First-time buyers are also at risk of being priced out of the market as lending conditions become tighter.

The average two-year fixed rate mortgage on Wednesday hit 6.15%, while five-year deals were 5.79%.

In a heated exchange at PMQs, Labour leader Sir Keir Starmer said Tory policies were to blame for the “mortgage catastrophe”.

“He [Rishi Sunak] knows very well the cause of the mortgage catastrophe – 13 years of economic failure and a Tory kamikaze budget which crashed the economy and put mortgages through the roof.

Prime Minister Rishi Sunak hit back citing “the global macroeconomic situation” and saying it had spent “tens of billions” supporting people with the cost of living.

UK problem?

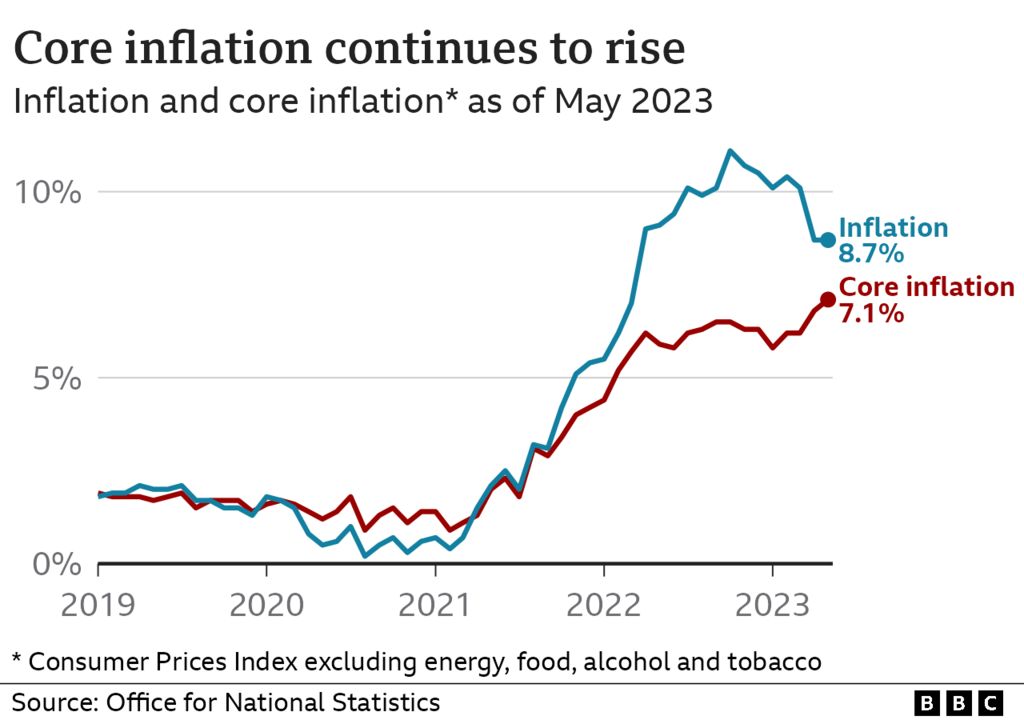

So-called “core” inflation, which strips out volatile factors such as direct energy and food prices, along with alcohol and tobacco prices, continued to rise last month rising at its fastest rate for 31 years.

Economists said this made the UK stand out from other countries such as the US and Germany where inflation is falling.

Grant Fitzner, chief economist at the Office for National Statistics (ONS), which produces figures on the UK economy, said the increase was being driven by rising service prices in cafes, restaurants and hotels.

“That’s probably driven, at least in part, by the increase we’ve seen in wages,” he added.

Yael Selfin, chief economist at KPMG UK, also said rising core inflation suggested firms might be passing on rising costs from higher wage bills to consumers,” she said.

UK wages have risen at their fastest rate in 20 years, excluding the pandemic, but are still lagging behind the rate of inflation.

This is a grim number. Inflation isn’t just stubborn, or sticky. It is, on the latest numbers, stuck. These figures should be falling by now, and they are in other countries such as the US and Germany.

My inbox was deluged with instant takes at 7am ranging from “unfortunate” to “challenging” to “disaster”.

Wednesday’s number shows that the already tricky balancing act between inflation and recession is getting worse. It may require more than just the Bank of England to do the heavy lifting.

Pay failing to keep up with price rises has led to many households come under financial pressure in recent months.

Food price inflation, which is the rate at which prices for groceries have risen compared to the year before, was 18.3% in May, down slightly from 19% in April.

Sergio Ronga, who owns Nanninella Pizzeria in Brighton, said he had to put his prices up as a result of higher costs.

He said costs had soared for his ingredients with tomatoes almost doubling in price, as well as flour rising by 60% and cheese jumping by 50%.

Sarah Coles, head of personal finance at Hargreaves Lansdown, said while food price inflation had eased, it was still at a level that “causes agony at the tills”.

“Costs have risen so far and so fast that we’re not going to see prices drop back to the level we were used to. In many cases we won’t actually see them fall at all: they’ll just get more expensive at a slower rate,” she said.

Separately, figures also released on Wednesday revealed that national debt was greater than the UK’s economic output for the first time since 1961.