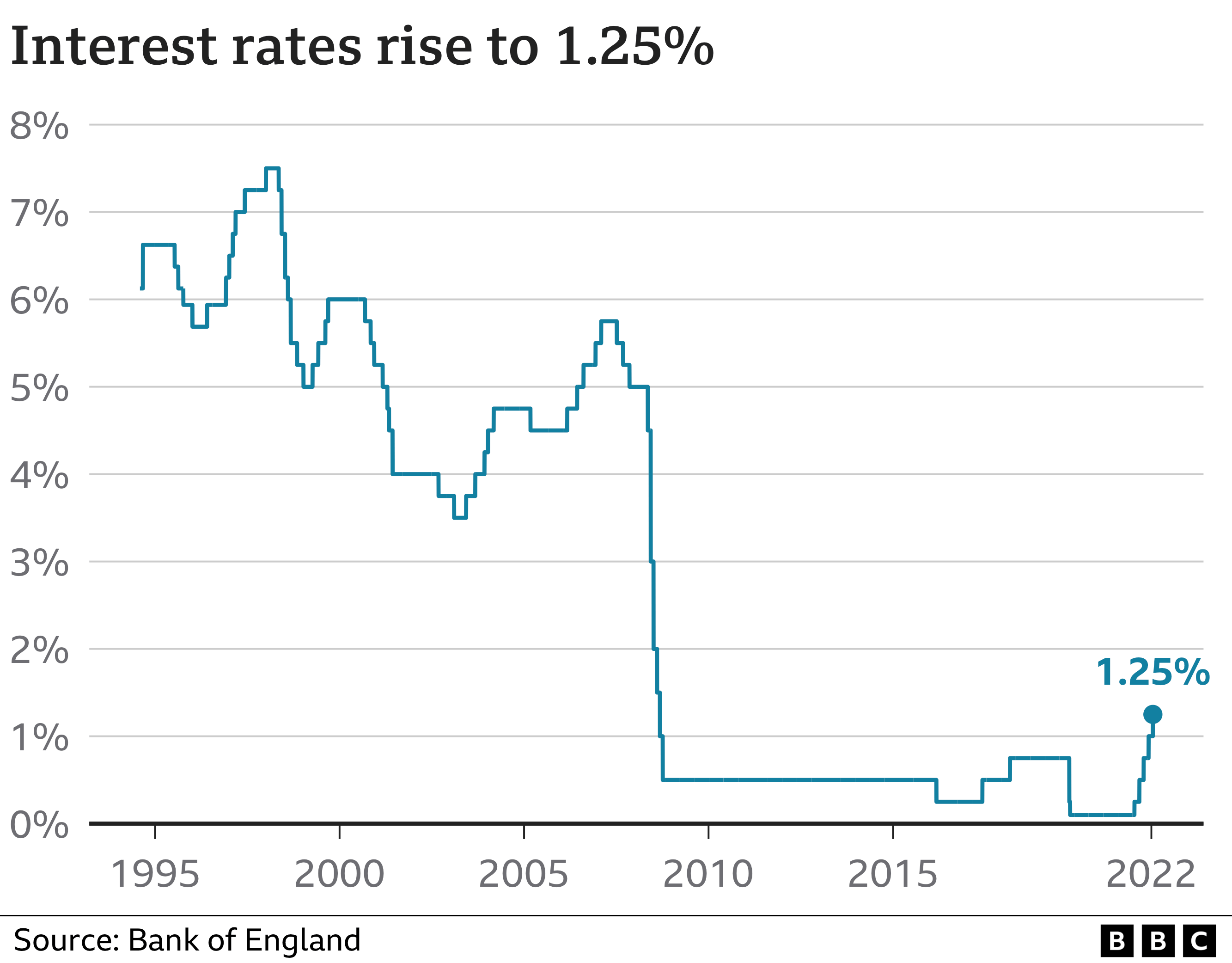

The Bank of England increases rates to 1.25% as it tries to stem the pace of rising prices.

Image source, Getty Images

Image source, Getty ImagesUK interest rates have risen further as the Bank of England attempts to stem the pace of soaring prices.

Rates have increased from 1% to 1.25%, the fifth consecutive rise, pushing them to the highest level in 13 years.

It comes as finances are being squeezed by the rising cost of living, driven by record fuel and energy prices.

Inflation – the rate at which prices rise – is currently at a 40-year high of 9%, and the Bank warned it could surpass 11% later this year.

The Bank said rising energy prices were expected to drive living costs even higher in October, but added it would “act forcefully” if necessary should inflation pressures persist.

The rate rise means that homeowners with a typical tracker mortgage will have to pay about £25 more a month. Those on standard variable rate mortgages will see a £16 increase.

However, about three-quarters of mortgage-holders have a fixed rate deal, so will not be immediately affected.

Six of the nine members of the Bank’s Monetary Policy Committee voted to raise rates to 1.25%, but three backed a bigger increase to 1.5%.

Minutes from the Bank’s meeting also reveal that it expects the UK economy will shrink by 0.3% in the April-to-June period.

The Bank did not update its outlook for the July-to-September quarter, but it has said previously that expects the economy to grow during this period.

If it does, then the UK would avoid a recession this year – with a recession defined as the economy shrinking for two consecutive quarters.

However, the Bank has also said previously that it expects the economy to shrink in the final three months of this year, during which the price cap on household energy bills is expected to be increased from £1,971 per year to about £2,800.

The rise in domestic gas and electricity bills will lift the increase in the cost of living to “slightly above” 11% in October, the Bank said.

It means the rate of inflation will be more than five times the Bank’s inflation target of 2%.

A very uncertain time

The Bank of England now expects the economy to be weaker immediately, with a fall in the economy in this quarter, and for inflation to be even higher, going above 11% in the autumn when the energy cap resets. It will flesh out these new forecasts in August.

The rise in interest rates to its highest level since February 2009 is intended to stop the global energy price shock becoming entrenched in the UK.

The Bank’s spies in every region of the economy say they do not pick up any sign of a reduction in demand for labour. Hence the rise to a rate that would still be considered low by historic standards, but may prove rather high to an economy, to homeowners and businesses that have become accustomed to ultra low rates after the financial crisis.

The Bank has also stopped giving guidance that more rate increases are on the way, and instead replaced that wording with an assurance that it will respond “forcefully” to any signs that inflation is becoming persistent.

Three members of the nine member committee voted for an even bigger rise of 0.5%, in the aftermath of the bumper 0.75% rise in rates in the USA overnight.

The Bank pointed to measures of core inflation, which strip out volatile energy prices for example, being significantly higher in the UK than in the euro area.

So the Bank is keeping open a path of further rises. But such is the economic squeeze and the fear of recession, that some economists predict some of these rises could be reversed within a year. It is a very uncertain time.

In a letter to Chancellor Rishi Sunak, the Bank’s governor, Andrew Bailey, said inflation was largely due to global issues such as rising prices for energy and agricultural goods, which have worsened as a result of Russia’s war with Ukraine.

But Mr Bailey said “domestic factors” also had a role in rising inflation such as the tighter labour market and rising prices in the services sector, which accounts for nearly three-quarters of the UK’s GDP.

He also noted that the UK’s inflation rate was higher than both the eurozone and the US.

Mr Bailey added that because it takes some time for wholesale gas and oil prices to be reflected in household bills – when the energy regulator Ofgem changes the price cap in April and October – “inflation is likely to peak later in the UK than in many other economies and may therefore fall back later”.

Other countries are also raising interest rates in an attempt to cool rising prices.

The US central bank has just announced its biggest interest rate rise in nearly 30 years, with the Federal Reserve increasing rates by three-quarters of a percentage point to a range of 1.5% to 1.75%.

Brazil, Canada, India, Australia and Switzerland have also raised rates, while the European Central Bank has outlined plans to do so later this summer.

-

- 1 hour ago