Klarna’s boss says people should mostly “pay with the money they have”, rather than take out credit.

The buy now, pay later firm Klarna is extending its services, including offering the choice of paying for items in full, immediately.

It said the “pay now” option and other changes it was making would give customers more clarity and control.

“Most of the time people should pay with the money they have,” said Klarna’s chief executive.

Buy now, pay later firms like Klarna have seen business boom over the last few years.

Klarna said it wanted to “drive up standards” in the buy now, pay later market by improving the way it operates and communicates.

It said it would perform more thorough checks on how much users could afford to borrow, and use clearer language during the checkout process to ensure customers understood they were taking on debt.

Like other buy now, pay later services, Klarna offers shoppers the opportunity of delaying or spreading the cost of a purchase without being charged fees or interest.

Instead Klarna charges retailers a small percentage of the transaction cost in exchange for providing the payment service.

The opportunity to pay in instalments appeals in particular to younger and low-income shoppers.

It allows customers to order several sizes of a clothing item, for example, in the expectation that those which don’t fit will have been returned and refunded before they are charged the full amount.

But such schemes have been widely criticised for encouraging shoppers to buy more than they can afford, with charities warning it can be a “slippery slope into debt”.

Critics say customers are bombarded with messages urging them to use buy now, pay later credit without a clear enough explanation of what it involves.

In particular, buy now, pay later firms have been accused of failing to explain that customers could be referred to debt collectors and that their credit scores could be affected if they miss payments.

Consumer group Which? recently found that although Klarna and other firms shared their guidelines with retailers about how their service should be presented, some retailers didn’t adhere to those guidelines.

Klarna is the largest buy now, pay later platform but many other firms offer a similar service, including Clearpay, LayBuy and Paypal.

Buy now, pay later services were used by five million people in the UK for total sales of £2.7bn in 2020. However, one in 10 people using them already had debt arrears elsewhere, a review by the Financial Conduct Authority found.

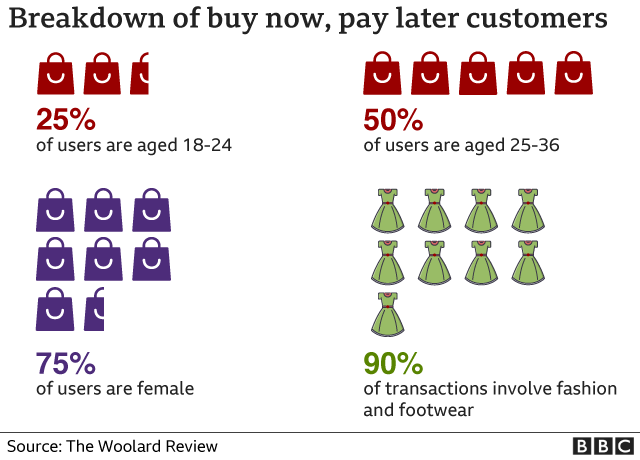

The review, led by Chris Woolard, found that three quarters of buy now, pay later users were under the age of 36 and the vast majority of transactions related to clothing purchases.

The Citizens Advice charity said it had found shoppers did not view buy now, pay later services as “proper borrowing” and many did not understand fully what they were signing up for.

The charity warned that four-in-10 of those who had used this type of credit in the previous 12 months were struggling to repay.

Klarna’s chief executive Sebastian Siemiatkowski said he believed there was a place for this kind of affordable credit offering.

“We firmly believe that most of the time, people should pay with the money they have, but there are certain times where credit makes sense,” he said.

“In those cases, our [buy now, pay later] products offer a sustainable and no-cost healthy form of credit – and a much needed alternative to high-cost credit cards.”

Klarna said it had worked with consumer group Fairer Finance to ensure its terms and conditions were “clear, simple and easy to understand”, and that the language during the checkout process made it “absolutely clear” there would be “consequences for missed payments”.

It had also improved its complaints procedure for dissatisfied customers, it said.

In February, the government announced it would review regulation of buy now, pay later products.