Domestic gas and electricity bills could fall sharply in April but many are still struggling to pay.

Image source, Getty Images

Image source, Getty ImagesEnergy prices are expected to fall sharply in April, with the regulator Ofgem announcing its new price cap later on Friday.

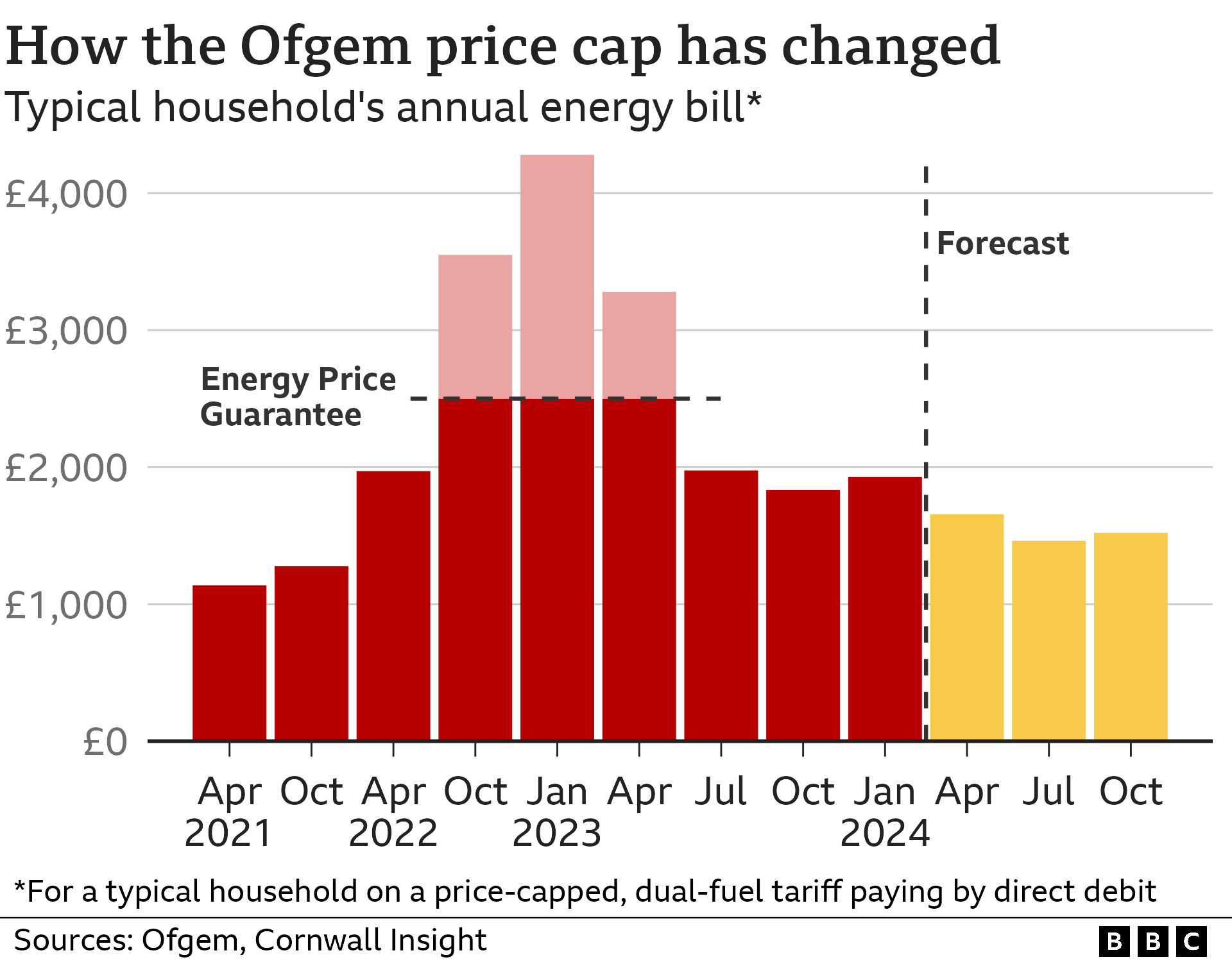

Consultancy Cornwall Insight has predicted a 14% drop, taking the typical annual bill to £1,656 – the lowest in more than two years.

Ofgem will make the announcement at 07:00 GMT when it outlines the price cap for April to June.

Campaigners say bills are still high and many will struggle to pay.

Bill drop

Ofgem’s price cap affects 29 million households in England, Wales and Scotland. Rules are different in Northern Ireland, where prices are also falling.

The regulator sets the maximum amount that suppliers can charge for each unit of gas and electricity but not the total bill, so if you use more, you will pay more.

Cornwall Insight has predicted the annual bill for a household using a typical amount of energy and paying by direct debit, will fall by £272 a year compared with the current level of £1,928.

The vast majority of people pay by direct debit, with payments smoothed out over the year. However, those who pay via prepayment meter – so often pay for energy as they use it – would have benefitted more had the cut come over the winter.

“To help counteract the higher fuel costs in winter, prepayment customers should be topping up their meter more than is needed during the summer, when energy usage is lower, to build up a credit reserve,” said Matthew Cole, head of Fuel Bank Foundation, a charity offering emergency help to prepayment meter households.

“However, we know that’s just not possible for the millions of low-income households already struggling just to keep the lights on, let alone find extra money for making additional meter top-ups.”

Even after any drop in the cost of energy, prices will remain above pre-pandemic levels.

Consumers also owe an estimated £2.9bn to energy suppliers. Ofgem is proposing lifting the cap by £16 between April and March next year to cover some of these bad debts.

Some householders have moved onto fixed deals, to get some certainty over how much they will pay and avoid fluctuations in the price cap.

Pensioner Jackie Honey, 69, has a fixed deal and has made significant changes to her lifestyle to keep her usage, and her bills, down.

That includes moving easy chairs into the kitchen and only heating that one room.

“I’ve worked all my life, and a lot of it being a single parent, I had to do two or three jobs, but I thought I had provided enough,” she said.

“I’ve reduced the house down to two one-bedroom flats but I still can’t do what I’d like to do, which is use my lounge.”

Financial support wound down

In the winter of 2022-23, overall energy prices were high and rises would have been bigger had it not been for the government’s Energy Price Guarantee limiting the typical bill to £2,500.

Each household also received £400 of support over six months, but the government did not repeat the discount this winter.

Cost-of-living payments seem set to end following a final instalment this month, and no plans have been announced for a continuation of the Household Support Fund, which councils use to offer direct support.

Chancellor Jeremy Hunt could choose to address future support when he presents his Budget on 6 March.

A spokesman for the Department for Energy Security said: “We’ve halved inflation and energy prices are now significantly lower than their peak – but we recognise the challenges families are still facing.”

What can I do if I can’t afford my energy bill?

- Check your direct debit: Your monthly payment is based on your estimated energy use for the year. Your supplier can reduce your bill if your actual use is less than the estimation.

- Pay what you can: If you can’t meet your direct debit or quarterly payments, ask your supplier for an “able to pay plan” based on what you can afford.

- Claim what you are entitled to: Check you are claiming all the benefits you can. The independent MoneyHelper website has a useful guide.