The Bank of England’s comments come as it announces another rise in rates to 5.25% from 5%.

Image source, Getty Images

Image source, Getty ImagesInterest rates are expected to rise for the 14th time in row as the Bank of England continues its battle to control stubbornly high price rises.

Most economists have predicted the Bank will increase rates to 5.25% from its current 5% at midday on Thursday.

That would mean higher interest rates on mortgages and loans for some people, but also higher savings rates.

UK inflation, the rate at which prices rise, remains elevated and is putting households under pressure.

The last time interest rates stood at 5.25% was 15 years ago in April 2008. However, a rise to 5.25% would mark a smaller increase than July’s dramatic rise to 5% from 4.5% and follows signs that price rises have begun to ease.

Inflation fell by much more than expected in June and at 7.9% is at its lowest level in over a year but remains nearly four times higher than the Bank of England’s 2% target.

Pantheon Macroeconomics said this meant policy makers would not need to hike interest rates as much as previously thought.

By making borrowing more expensive the Bank’s aim is that people will spend less money, meaning households will buy fewer things and then price rises will ease.

But it is a balancing act as raising rates too aggressively could cause the economy to slump, but not raising them at all could lead to inflation rising even more.

Free market think tank the Institute of Economic Affairs (IEA) said the Bank should wait for previous interest rate rises to take effect before raising rates further.

”It will take some time for previous rate rises and falling global commodity prices to feed into lower inflation.

“Further rate rises are unnecessary and could do some economic damage without lowering inflation any faster. The UK economy is on the precipice of a sharper slowdown,” said Trevor Williams, a member of IEA and former chief economist at Lloyds Bank.

Mr Bailey has previously denied the Bank has been trying to cause a recession – which is usually defined as the economy shrinking for two three-month periods in a row- in a bid to tackle soaring prices.

“Many people with mortgages or loans will be understandably worried about what this means for them… but inflation is still too high and we’ve got to deal with it,” he said at the Bank’s previous interest rate decision.

There are signs that higher rates are already affecting the UK economy with house prices falling at their fastest annual rate in 14 years in July, according to Nationwide.

On Wednesday, Prime Minister Rishi Sunak told LBC radio that inflation was not falling as fast as he would like, but that he believed people could “see light at the end of the tunnel”.

What’s the impact?

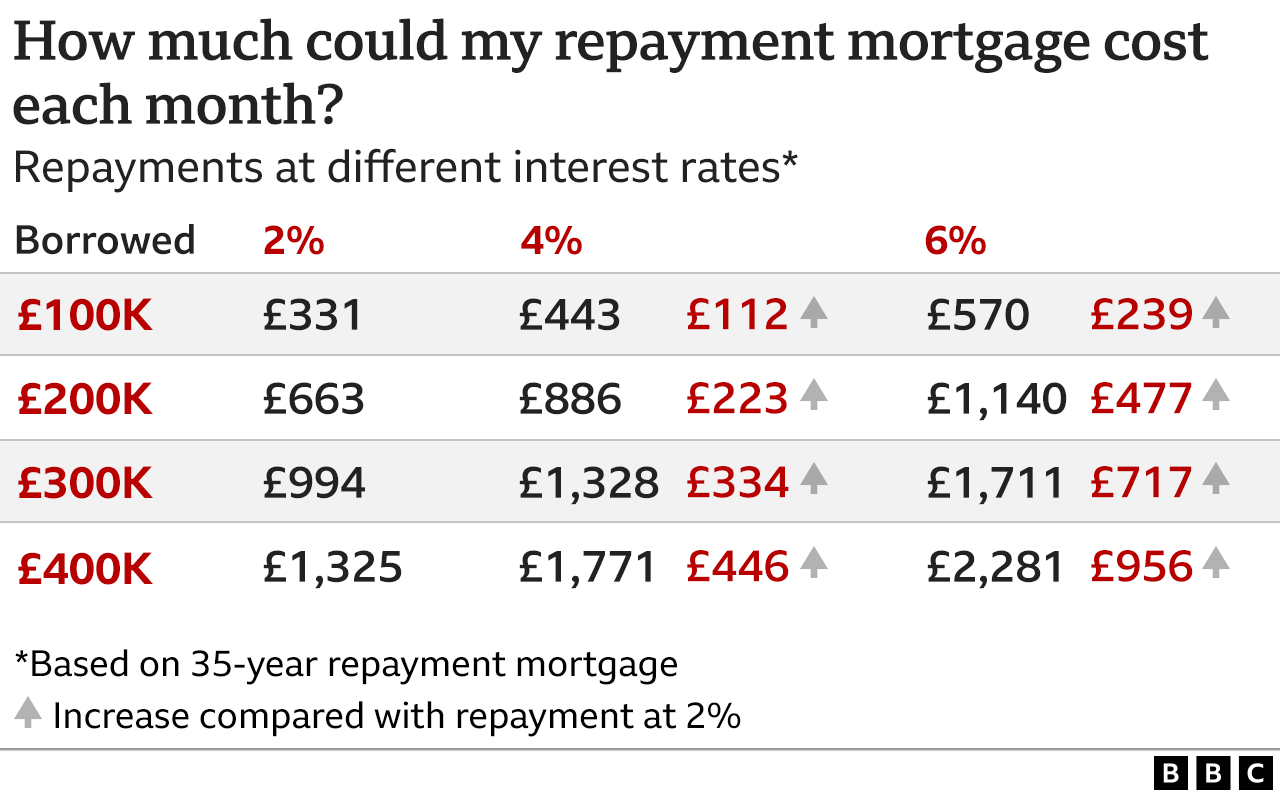

A rise in rates would affect different people in different ways.

Mortgage holders with variable or tracker mortgages, or those who are looking to secure a new fixed-rate deal, will find it costs more to borrow the money for their homes.

In the event of a 0.25% increase, people on a typical tracker mortgage will pay about £23.71 more a month, while those on standard variable rate (SVR) mortgages face a £15.14 jump on average.

The majority of mortgage holders are on fixed-rate deals, which shields them from the current interest rates rises, but about 800,000 deals will end by the end of this year and 1.6 million more will do so in 2024.

Hopes that the Bank of England might not have to raise rates as high as previously forecast have helped to bring down fixed-rate mortgage rate deals in recent weeks, although they still remain much higher than the levels they were at two years ago.

Jane Foley, head of FX strategy at Rabobank, told the BBC’s Today programme that the costs of fixed-rate deals “are more tied to money market rates which factor in expectations of where rates will be in two years or one year etc”.

UK interest rates had previously been expected to peak above 6% but when inflation eased in June, markets changed their forecasts to a peak of around 5.85%.

Ms Foley said that if the Bank signals that core inflation is stabilising and interest rates are close to a peak, “money market rates may not move, they may even come down a bit”, which could cut the cost of fixed-rate deals further.

Other impacts of higher rates include charges on some non-secured loans and credit cards going up.

However, people with savings should get better returns on their money – though banks have been condemned for “weak excuses” over their savings rates on offer.

For the government though, a rise in rates will have a knock-on effect meaning it has to pay more interest on the country’s debt.

Are you affected by the rise in interest rates? You can share your experiences by emailing haveyoursay@bbc.co.uk.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can’t see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk. Please include your name, age and location with any submission.

What to do if I can’t pay my debts

- Talk to someone. You are not alone and there is help available. A trained debt adviser can talk you through the options. Here are some organisations to get in touch with.

- Take control. Citizens Advice suggest you work out how much you owe, who to, which debts are the most urgent and how much you need to pay each month.

- Ask for a payment plan. Energy suppliers, for example, must give you a chance to clear your debt before taking any action to recover the money

- Check you’re getting the right money. Use the independent MoneyHelper website or benefits calculators run by Policy in Practice and charities Entitledto and Turn2us

- Ask for breathing space. If you’re receiving debt advice in England and Wales you can apply for a break to shield you from further interest and charges for up to 60 days.

Tackling It Together: More tips to help you manage debt

Sign up for our morning newsletter and get BBC News in your inbox.