The Bank of England says bond-buying help will end on Friday, but a report suggests it could be extended.

Image source, Getty Images

Image source, Getty ImagesThe Bank of England boss says it will stop buying bonds to help pension funds this week despite pleas to continue.

The emergency bond-buying programme aimed at stabilising their price and preventing a sell-off that could put some pension schemes at risk of collapse is due to end on Friday.

“You’ve got three days left now and you’ve got to sort it out,” Andrew Bailey told pension funds.

The Bank acted after September’s mini-budget which sparked market turmoil.

The chancellor promised huge tax cuts without saying how he would fund them, sparking investor fears over the UK’s financial stability.

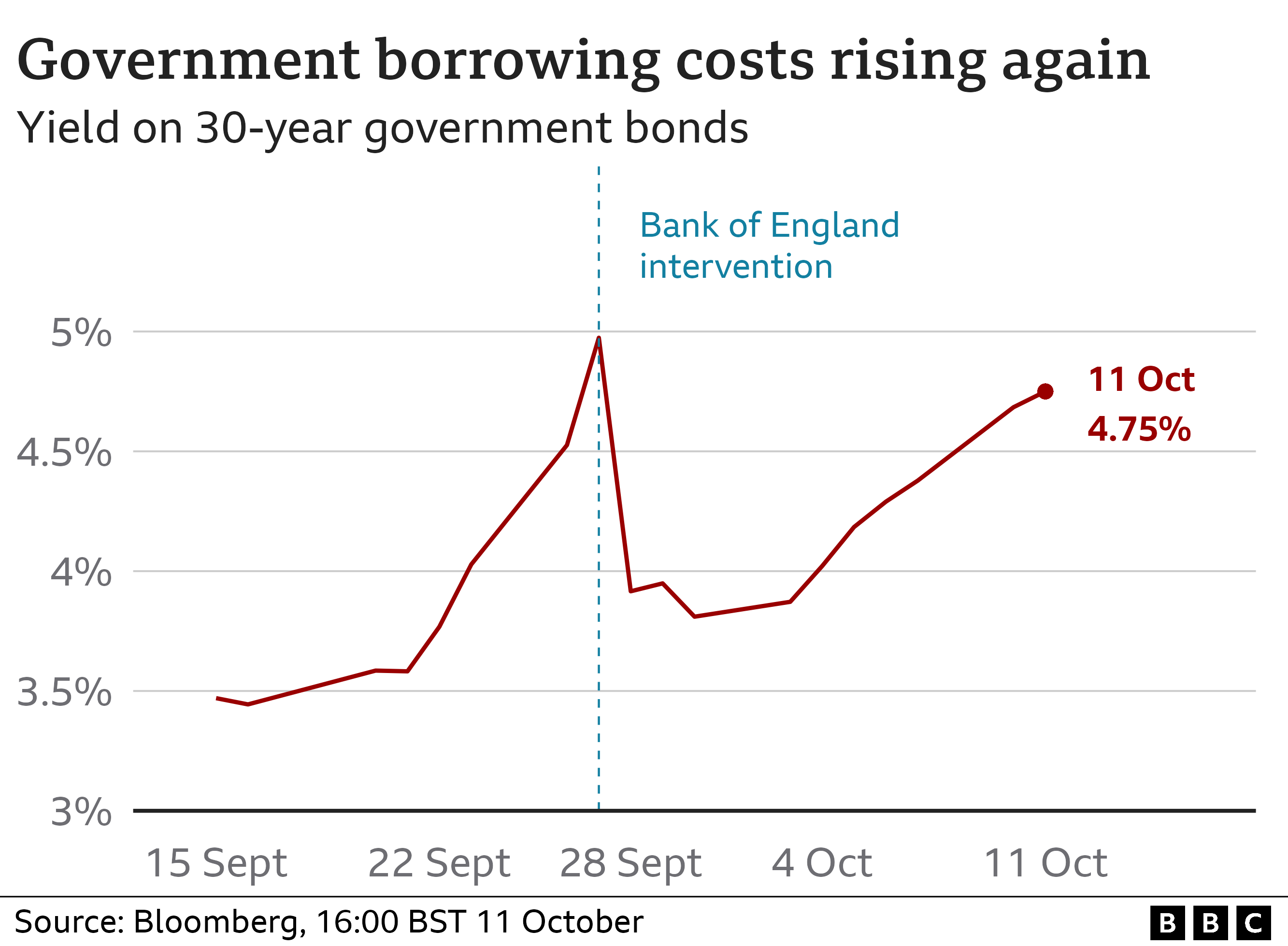

The pound fell against the dollar to below $1.10 after Mr Bailey’s surprisingly blunt statement which dashed investor hopes of the support being extended. And government borrowing costs remain close to the levels seen at the height of the market turmoil last month.

The government raises money it needs for spending by selling bonds – a form of debt that is paid back plus interest in anywhere between five and 30 years.

Pension funds invest in government bonds because they provide a low but usually reliable return over a long period of time, but were hit by sharp falls in their value after the mini-budget.

The turmoil forced pension funds to sell bonds, threatening to create a downward spiral in their prices as more were offloaded which left some funds close to collapse.

It has also fed through to the mortgage market, where hundreds of products have been suspended as the volatility in bond markets made it difficult for lenders to know how to price these long-term loans.

Last week, interest rates on typical two and five-year fixed rate mortgages topped 6% for the first time in over a decade.

Mr Bailey told the BBC he had stayed up at night to try and find a solution and said it was doing everything it could to preserve financial stability, but it has always said the help would be temporary.

The blunt warning was no slip of the tongue with the governor going out of his way to say the City giants now had to arrange their affairs.

He said pension funds have “an important task” to ensure they are resilient.

“I’m afraid this has to be done, for the sake of financial stability,” he said.

‘Uncharted territory’

Earlier pensions industry body the Pensions and Lifetime Savings Association had warned against the help ending “too soon”.

It suggested the support should be extended until 31 October when chancellor Kwasi Kwarteng is due to detail his economic plan, explaining how he will balance the public finances. The statement will be accompanied by independent forecasts on the prospects for the UK economy.

Despite Mr Bailey’s insistence on ending the support, the Bank of England has signalled privately to bankers that it could extend its emergency bond-buying scheme beyond this week, according to the Financial Times.

The Bank declined to comment.

Former pensions minister Steve Webb, who now works for pension consultants LCP, said he thought Mr Bailey may have to extend the help.

“It’s not a fantastically good thing for pension funds to be furiously selling assets over a two-week period, so it’s perfectly possible, although a lot has been done, that more help will be needed from the Bank on Friday,” he told BBC Radio 4’s The World Tonight, adding: “We are in uncharted territory”.

At times of previous high borrowing costs and financial stress, the Bank has bought up government bonds for long periods of time.

Mr Bailey has made it clear that will not happen on this occasion and that the Bank will not stand in the way of the market pushing up the ost of government borrowing as a response to uncertainty over its economic policy.

The government has said it remains confident in its tax cuts plan, with Mr Kwarteng telling MPs he was “relentlessly focused on growing the economy” and “raising living standards”.

But Mr Bailey’s words further increases the pressure on the government, and the chancellor, to come up with an economically credible and politically viable debt plan, and quickly.

But Labour’s shadow chancellor Rachel Reeves said: “This is a Tory crisis that has been made in Downing Street, and that is being paid for by working people.”

Former IMF deputy director Mohamed El-Erian told BBC News that the economy was on “shaky ground”.

He said financial systems going into turmoil “can cause a lot of damage”.