A two-year government-set cap means price rises taking effect on Saturday are lower than expected.

Image source, Danny Lawson/PA Wire

Image source, Danny Lawson/PA WireEnergy prices will rise for millions of households on Saturday, but the increase has been cushioned by a government cap on the cost per unit.

It stepped in after an 80% increase in domestic gas and electricity bills was earmarked for the first half of winter.

A typical annual bill will go up from £1,971 to £2,500 but will be further mitigated by cost-of-living payments.

But prices will still be twice as high as last winter, and charities say that will leave many struggling.

The squeeze will be particularly acute for those on prepayment meters, who pay for energy as they use it, and so have largely been unable to smooth out increased bills over the year.

“The most vulnerable, including children, will be cold and hungry as energy prices spiral, despite government support,” said Adam Scorer, from charity National Energy Action.

People paying by direct debit tend to build up credit during the warmer, lighter summer months which then funds some of their extra use during the winter.

‘We are trying our best’

Jaqueline Jones in Urmston in Manchester says she and her husband Joe are already taking steps to cut down on their energy bills.

“We’re only filling the kettle to the amount we need, watching how often we put the washing machine on – little things like that,” she said.

They are also hanging washing indoors and finishing it off for 10 minutes in the dryer, as opposed to using the dryer more often.

They are on a standard variable tariff for their electricity and energy bills, but haven’t received an updated bill recently to know whether the measures are making a big difference as of yet.

“Hopefully when the actual bill does come in it won’t be too much,” Jacqueline says, adding that she is now watching their smart metre every time they make a cup of tea.

“I watch the numbers every time I put the kettle on – oh my goodness how it whizzes around!”

But she says the situation overall is frightening for the couple who are retired and rent a Victorian property.

“We’re both pensioners and we don’t have a great pension other than the government one, so we have to make sure it’s going to last out, along with the bit of savings we do have.

“We’ll just have to see and play it by ear… but we are trying our best.”

New price cap

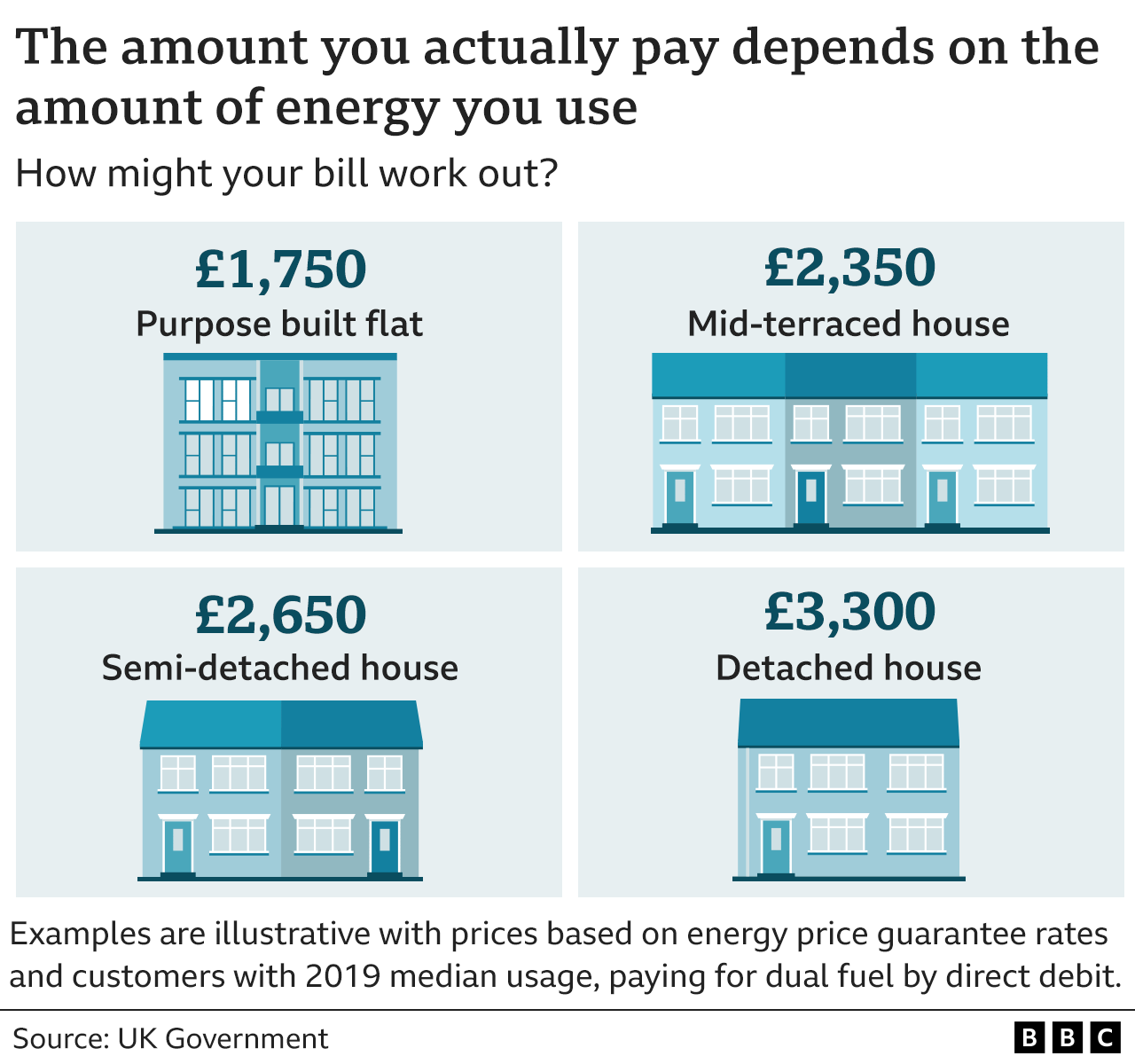

Every household pays for the energy it uses. There is no absolute cap on the total cost.

Under the government’s two-year price guarantee, the average unit price for dual fuel customers paying by direct debit on variable deals will be limited to 34p per kilowatt hour (kWh) for electricity and 10.3p per kWh for gas.

With standing charges added, it means a typical household – one that uses 12,000 kWh (kilowatt hours) of gas a year, and 2,900 kWh of electricity a year – will not pay more than £2,500 a year for energy from Saturday.

Without this intervention, that annual bill would have been £3,549 a year, rising from the current and soon-to-expire level of £1,971 a year. Those on prepayment meters pay slightly more.

The chancellor, Kwasi Kwarteng said that the government’s “energy intervention” meant that people across the country were protected.

However, last winter, the price cap – governed by the energy regulator Ofgem – meant the same typical household paid £1,277 a year.

That doubling of a typical energy bill is why millions of households have cut back on their energy use, according to a survey by the consumer group Which?.

Its findings, which it shared with BBC News, suggested that 58% of those asked reported reducing their usage of lights and appliances around the home. More than four in 10 said they had reduced hot water consumption, including taking fewer and shorter showers.

Given the wider context of rising prices, the consumer group also said that 60% of those surveyed had bought cheaper food products than usual and 36% had planned meals more, for example by batch cooking.

Which? has launched a campaign calling on supermarkets, telecoms and energy businesses to offer more support to customers facing financial difficulty, such as ensuring cheaper social broadband tariffs and value-range food is equally accessible to shoppers across the country.

“While government intervention is necessary, we also believe businesses across essential services can and should do more to help,” said Rocio Concha, its director of policy and advocacy.

Cost-of-living payments

The government’s earlier package of cost-of-living payments is continuing.

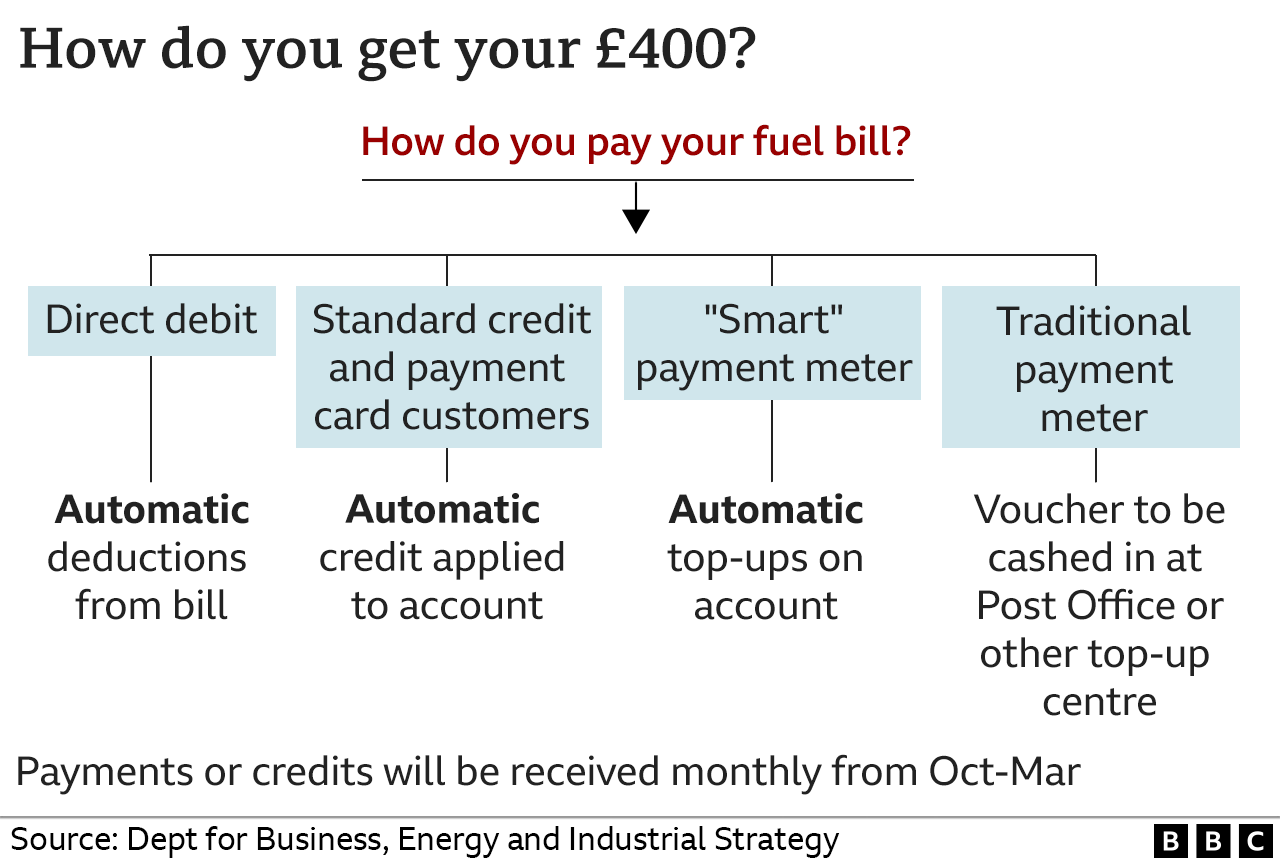

The next stage begins from Saturday when everyone’s energy bill will eventually be cut by £400. The discount will be applied over six months, with a reduction of £66 in October and November, and £67 every month between December and March 2023.

The discount will be made automatically by energy suppliers in England, Scotland and Wales, with plans for the equivalent to be paid in Northern Ireland.

There will be further payments later in the winter for people who receive benefits and are on low incomes, and pensioners.

The energy plans were in place ahead of last Friday’s tax-cutting mini-budget which has been followed by days of turmoil on the markets.

The government has said its energy guarantee would cost £60bn for the first six months.

However, industry analysis suggests the total bill could be between £130bn and £150bn.

The cost will be met by an increase in government borrowing, but the likely cost of this has soared after financial markets reacted badly to the chancellor’s plans to introduce tax cuts worth £45bn.

There are also fears that the upheaval might affect the housing market.

Hundreds of mortgage products have been pulled since Friday, and are likely to return at higher costs, amid fears the Bank of England will have to raise interest rates much more sharply than previously expected.