A simple guide to how currency is valued and what it means for your finances.

Image source, Getty Images

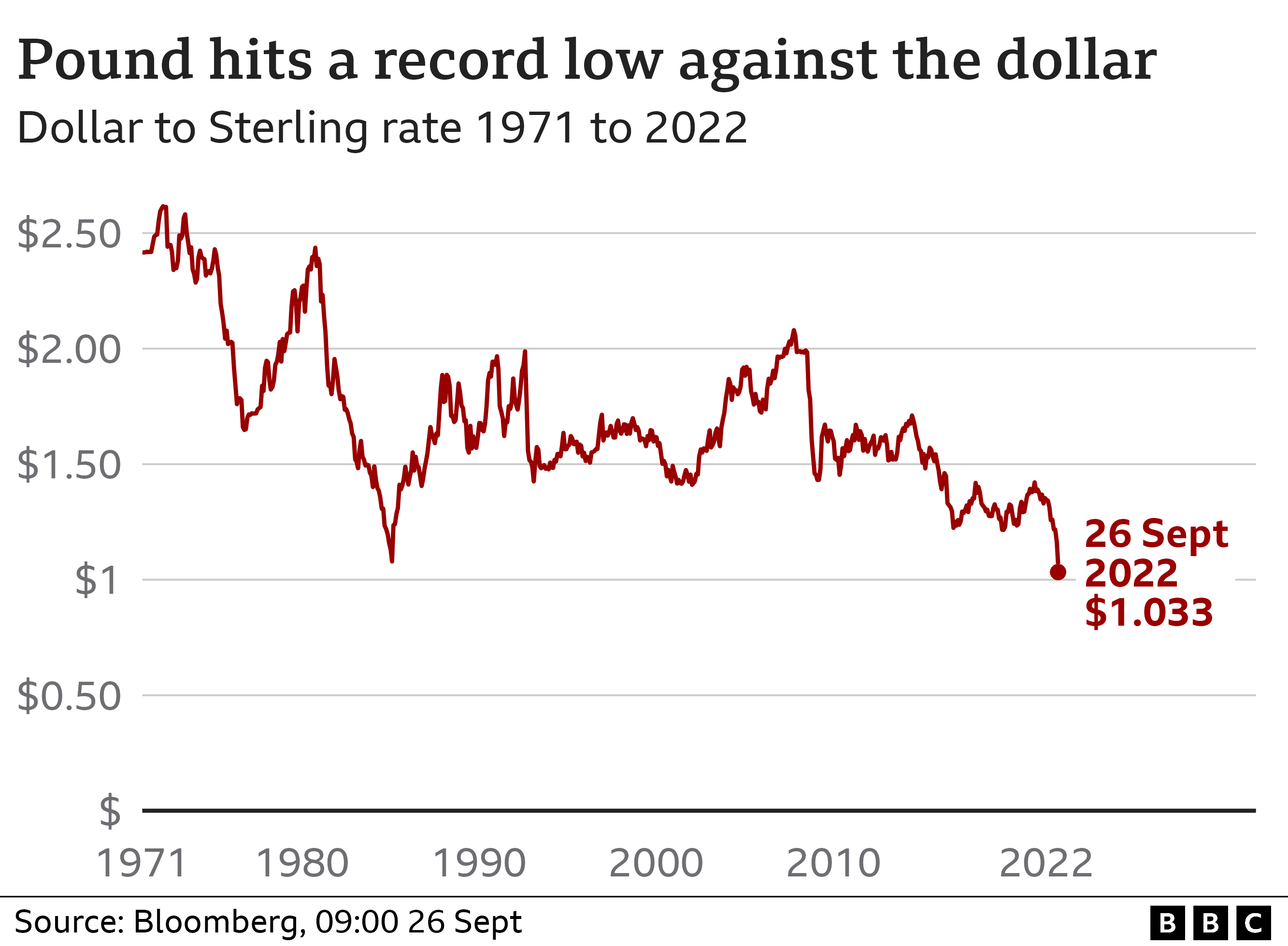

Image source, Getty ImagesThe value of the pound has fallen to a record low against the dollar. It has also dropped against the euro.

It comes after the UK government announced large tax cuts, which will be paid for by borrowing billions of pounds.

How does a weak pound affect me?

The pound’s value affects everyone – from shoppers to business owners and investors.

It hits household finances by increasing the prices of things we buy.

This is because if the pound is worth less, the cost of goods from overseas goes up.

For example:

- Energy – the price of all of the gas that the UK uses is based on the dollar

- Petrol – oil is priced in dollars, so a weak pound can make filling up your car more expensive

- Food prices – the UK imports 46% of the food it consumes, mostly from the EU

- Technology, like mobile phones, or cars made abroad, could get more expensive

Even things made in the UK can cost more if parts are bought from other countries.

Overall, the falling pound could increase the cost of living by 0.5 percentage points next year, according to Samuel Tombs of research firm Pantheon Economics.

Many people also think about exchange rates when they swap money for a foreign holiday. When you travel abroad, things will be more expensive if the pound buys less of the local currency.

Why has the pound tumbled?

Investors around the world buy and sell huge amounts of foreign currency. The aim is to profit by hoping the currency bought goes up in value more than the one sold.

The pound plummeted on Friday after the government announced huge tax cuts in its mini-budget.

It then plunged again in on Monday, reaching $1.04 – the lowest level the pound has ever been against the dollar.

The cause is investors selling the pound because they have doubts about the government’s plans, said Jane Foley, of Rabobank.

“They’re worried that some of these tax cuts that have been announced aren’t going to be fully-funded. That will result in a large amount of debt at a time when the Bank of England is going to be selling some of its holdings of UK government debt,” she said.

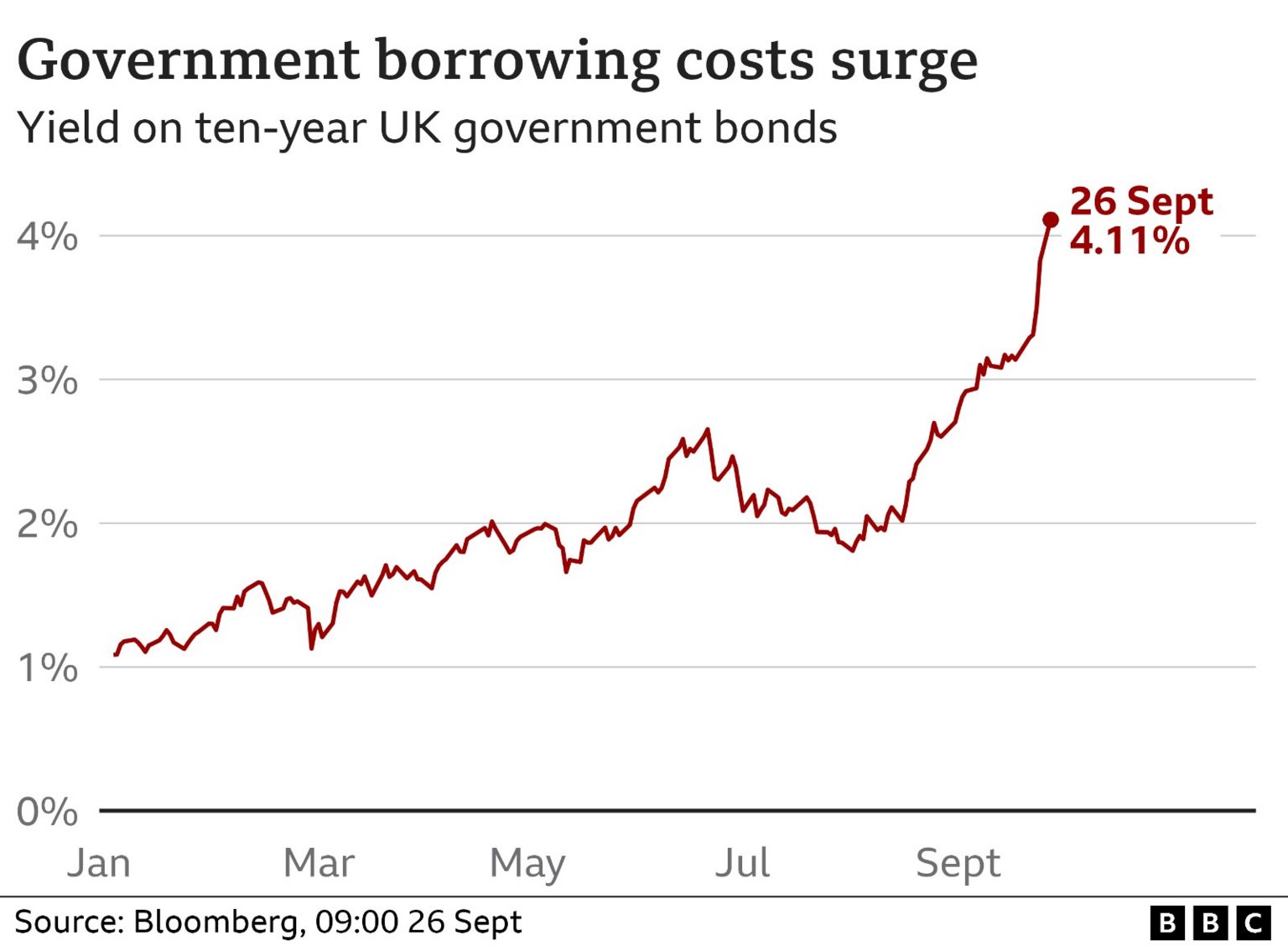

Investors’ concerns about UK public finances have also made it much more expensive for the government to borrow.

The interest on 10-year bonds – which governments sell to investors – has risen from just over 1% in January, to more than 4% now.

This shows that investors are worried the government’s tax cuts will force the Bank of England to raise interest rates higher, said Paul Dales from Capital Economics,

He said they are concerned about “the UK’s long-term growth prospects”.

The Bank of England isn’t set to hold its next interest rate meeting until November. However, there is speculation the Bank could step in with an interest rate rise sooner.

Image source, Getty Images

How is currency valued?

Exchange rates change constantly, because they reflect shifting demand for each country’s currency across the globe.

Demand is affected by lots of things, including:

- Economy: Successful economies have strong currencies because other countries want to invest there. They need the local currency to do so, pushing up demand and its value

- Savings: If the Bank of England raises interest rates, holding savings or investments in pounds becomes more attractive, as you get more back for your money. So, demand for sterling increases

- Prices: If UK goods are cheaper than those abroad, they are attractive to foreign businesses who need sterling to purchase them. This will tend to push up the exchange rate

- Public finances: The state of a government’s bank balance, or how much debt it has, can also affect the exchange rate.

- Speculation: The exchange rate is highly vulnerable to currency speculators, who buy and sell sterling based on expectations of future events