The government is taking a dangerous gamble, Angela Rayner says, but ministers argue tax cuts will get the economy growing.

This video can not be played

To play this video you need to enable JavaScript in your browser.

The government’s tax cuts will benefit the richest 1% and make the next generation worse off, Labour has said.

Deputy leader Angela Rayner told the BBC the chancellor’s approach of “trickle-down economics” was a “dangerous gamble”.

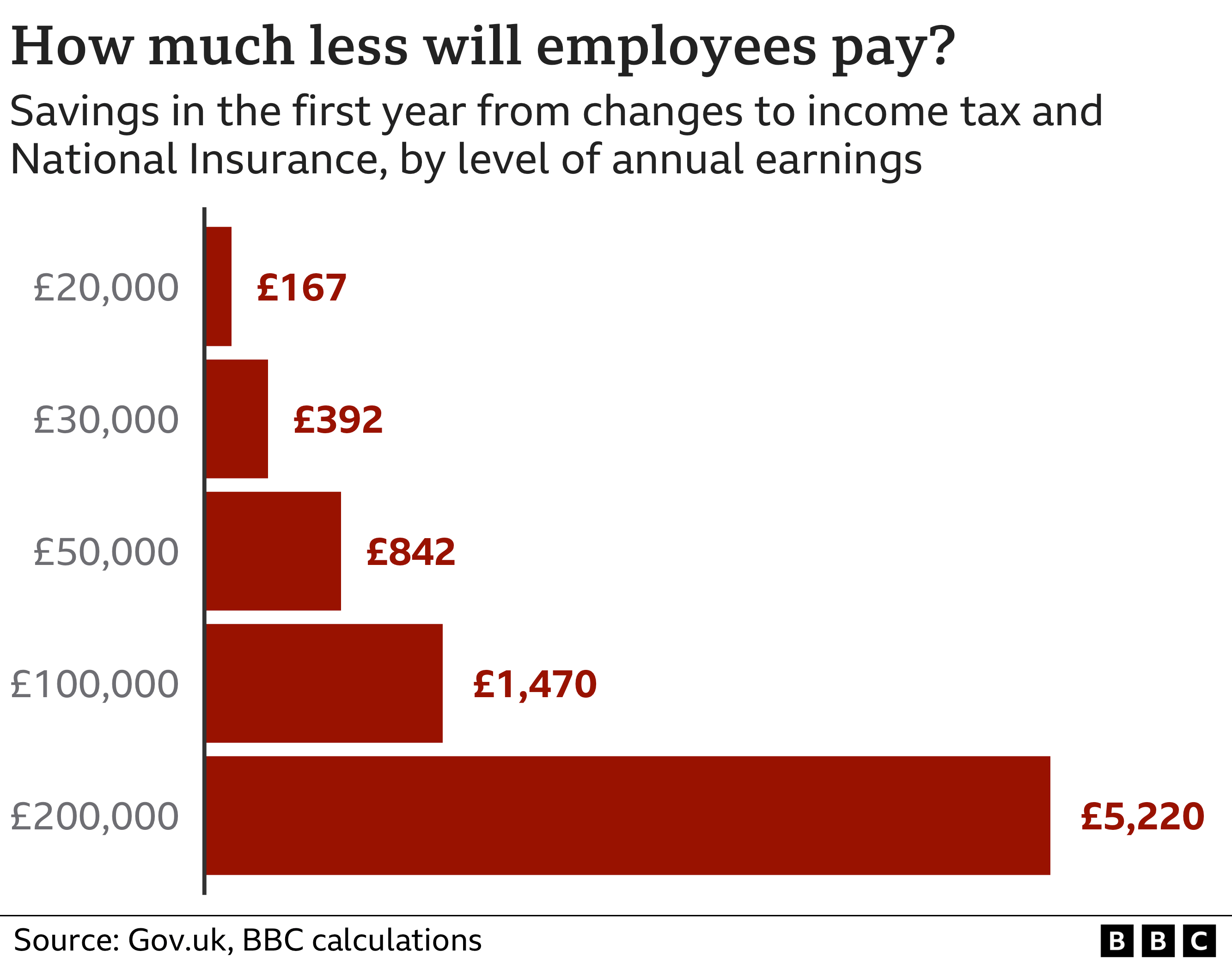

Independent think tank the Institute of Fiscal Studies said the richest 10% of households would gain the most.

But Chief Secretary to the Treasury Chris Philp said tax cuts for all would get the economy growing.

Chancellor Kwasi Kwarteng unveiled the biggest package of tax cuts in 50 years on Friday, including the scrapping of the top rate of income tax.

He also cut stamp duty for homebuyers, and brought forward a cut to the basic rate of income tax, to 19p in the pound, a year early to April.

The measures will be paid for by a sharp rise in government borrowing amounting to tens of billions of pounds.

Speaking ahead of Labour’s party conference, Ms Rayner called the plans “a very dangerous gamble on our economy and future generations”.

“It’s the top 1% who will make the most significant gain from those tax cuts,” she said.

“I don’t accept the argument of trickle down economics – which is what this is – give those at the top loads more money and that will filter down to those at the bottom. That’s not how it works.”

She added: “We’re going to saddle the next generation with more debt.”

The announcements by Mr Kwarteng came after the Bank of England warned the UK may already be in a recession and raised interest rates to 2.25%.

During an interview with BBC News political editor Chris Mason, the chancellor said: “I don’t think it’s a gamble at all.

“What was a gamble, in my view, was sticking to the course we are on.”

Meanwhile, the IFS published analysis suggesting that only those earning over £155,000 would see any benefits from the tax policies, with the “vast majority of income tax payers paying more tax”.

The think tank also said the chancellor was “betting the house” by putting government debt on an “unsustainable rising path”, and with money being pumped into the economy when inflation remains high.