The Bank of England will announce its decision later with a seventh consecutive rise expected.

Image source, Getty Images

Image source, Getty ImagesInterest rates are expected to rise for a seventh time in a row when an announcement is made later on Thursday.

The Bank of England is widely expected to increase rates by half a percentage point, or possibly more.

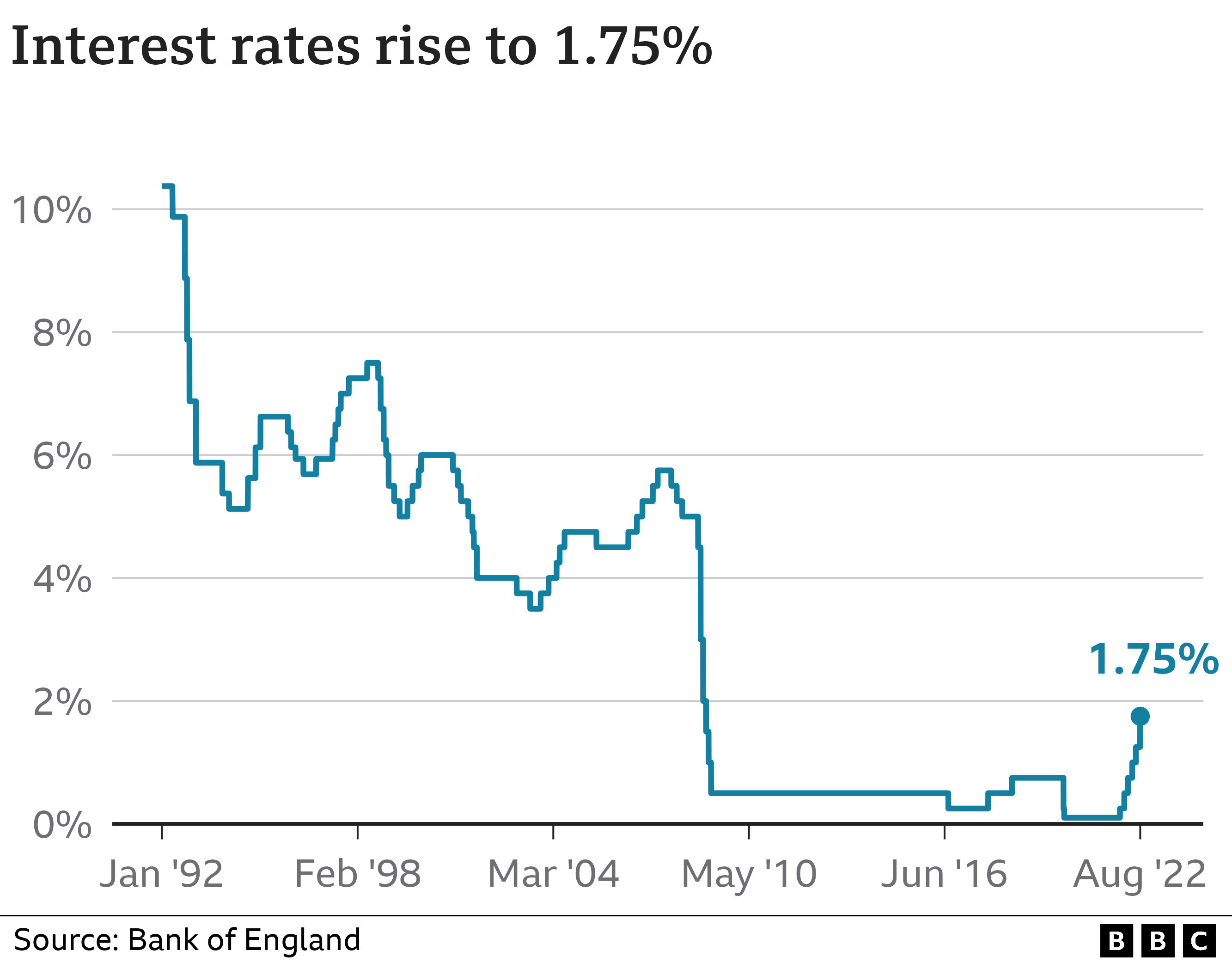

Last month’s half a percentage point rise to 1.75% was the largest increase for 27 years.

Such a move would be an attempt to slow the rate of rising prices. The last time interest rates were this high was during the 2008 financial crisis.

Why does raising interest rates help lower inflation?

Prices are going up quickly worldwide, as Covid restrictions have been eased and consumers spend more.

Many firms have problems getting enough goods to sell. And with more buyers chasing too few goods, prices have risen.

There has also been a very sharp rise in oil and gas costs – a problem made worse by Russia’s invasion of Ukraine.

One way to try to control rising prices – or inflation – is to raise interest rates.

This increases the cost of borrowing and encourages people to borrow and spend less. It also encourages people to save more.

However, it is a tough balancing act as the Bank does not want to slow the economy too much.

Since the global financial crisis of 2008, UK interest rates have been at historically low levels. Last year, they were as low as 0.1%.

How high could interest rates go?

Analysts have predicted UK interest rates will rise this month, but further increases are also expected later in the year and into 2023.

Last year, the Office for Budgetary Responsibility (OBR) – the government’s independent economic adviser – looked at what might happen if the UK were to experience higher and longer lasting inflation.

This can happen when people think price rises will continue – businesses raise prices to keep making a profit and workers demand wage increases to keep up.

If this happens UK interest rates could hit 3.5%, the OBR said.

How do interest rates affect me?

Mortgages

Just under a third of households have a mortgage, according to the English Housing Survey, which is geographically limited but one of the most comprehensive guides available.

Of those, three-quarters have a fixed mortgage, so will not be immediately affected. The rest – about two million people – will see their monthly repayments rise.

If rates are raised to 2.25%, those on a typical tracker mortgage would have to pay about £49 more a month. Those on standard variable rate mortgages would see a £31 increase.

This comes on top of increases following other recent rate rises.

Compared with pre-December 2021, tracker mortgage customers could already be paying about £167 more a month, and variable mortgage holders about £132 more.

Credit cards and loans

Even if you don’t have a mortgage, changes in interest rates could still affect you.

Bank of England interest rates also influence the interest charged on things like credit cards, bank loans and car loans.

Even ahead of the latest decision, the average annual interest rate is 19.9% on bank overdrafts and 18.57% on credit cards in July. Lenders could decide to increase these fees if interest rates rise again.

Savings

The Bank’s decisions also affect the interest rates people earn on their savings.

Individual banks usually pass on any interest rate rises – giving savers a higher return on their money.

However, for people putting money away, interest rates are not keeping up with rising prices.

How does the Bank of England set interest rates?

Interest rates are decided by a team of nine economists, the Monetary Policy Committee.

They meet eight times a year – roughly once every six weeks – to look at how the economy is performing.

Their decisions are always published at 12:00 on a Thursday.

Are other countries raising their interest rates?

The UK is affected by prices rising across the globe. So there is a limit as to how effective UK interest rate rises will be.

However, other countries are taking a similar approach, and have also been raising interest rates

The US central bank has announced big rate rises in the last few months. Other central banks around the world have also raised rates.

How will you be affected by any change to interest rates? Share your experiences by emailing haveyoursay@bbc.co.uk.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch in the following ways:

- WhatsApp: +44 7756 165803

- Tweet: @BBC_HaveYourSay

- Upload pictures or video

- Please read our terms & conditions and privacy policy

If you are reading this page and can’t see the form you will need to visit the mobile version of the BBC website to submit your question or comment or you can email us at HaveYourSay@bbc.co.uk. Please include your name, age and location with any submission.