Bank of England governor Andrew Bailey warns price rises would be long-term if Bank did not act.

This video can not be played

To play this video you need to enable JavaScript in your browser.

The governor of the Bank of England has defended its decision to raise interest rates, saying there is a “real risk” of soaring prices becoming “embedded”.

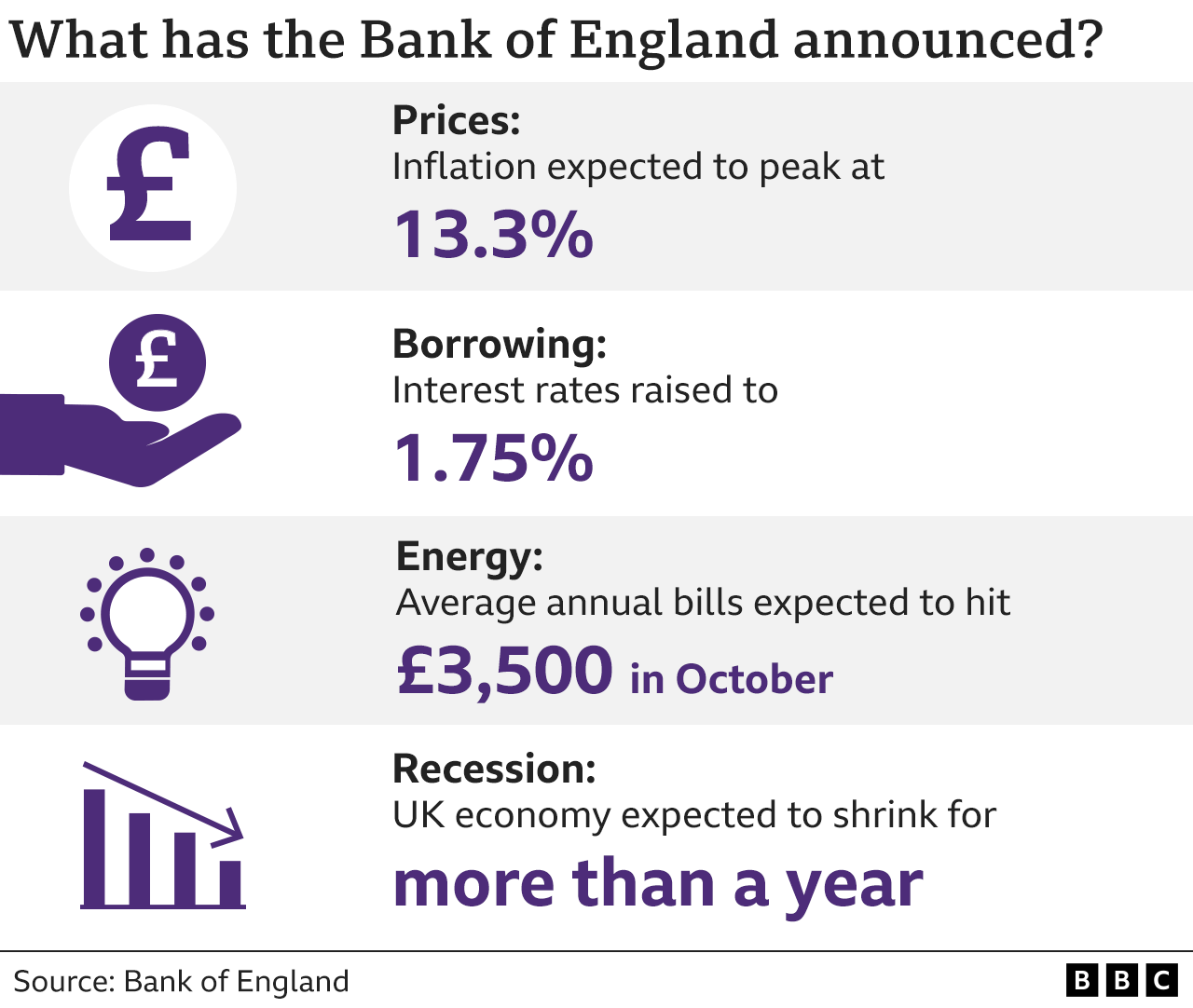

Interest rates rose to 1.75% – the biggest rise in 27 years – with inflation now set to hit more than 13%.

The UK is forecast to fall into recession this year, with the longest downturn since 2008 predicted.

Increasing interest rates is one way to try and control inflation as it raises borrowing costs.

This should encourage people to borrow and spend less. It can also encourage people to save more.

However, many households will be squeezed further following the interest rate rise, including some mortgage-holders.

The Bank’s governor, Andrew Bailey, told BBC Radio 4’s Today programme: “The real risk we’re responding to is that inflation becomes embedded and it doesn’t come down in the way that we would otherwise expect.”

“We’ve had a domestic shock, we’ve had a shrinkage in the labour force over the last two years or so,” he said.

“The first thing that businesses want to talk to me about is the problems they’re having hiring people… They’re also saying to us, actually they’re not finding it difficult to raise prices at the moment. Now we think that can’t go on.”

UK inflation – the rate at which prices rise – is currently at 9.4% – the highest level for more than 40 years.

But the Bank has warned it could peak at more than 13% and stay at “very elevated levels” throughout much of next year, before eventually returning to the Bank’s 2% target the following year.

The main reason for high inflation and low growth is soaring energy bills, driven by Russia’s invasion of Ukraine.

Households have also been hit by higher petrol, diesel and food costs.

Have you experienced recession before? How did your life change? Please email: haveyoursay@bbc.co.uk.

Please include a contact number if you are willing to speak to a BBC journalist. You can also get in touch via WhatsApp: +44 7756 165803 and Twitter: @BBC_HaveYourSay

The economy is forecast to shrink in the final three months of this year and keep shrinking until the end of 2023.

The expected recession would be the longest downturn since 2008, when the UK banking system faced collapse, bringing lending to a halt.

The slump is not set to be as deep as 14 years ago but may last just as long.

Meanwhile, higher interest rates will hit some mortgage holders.

Now rates have gone up to 1.75%, homeowners on a typical tracker mortgage will have to pay about £52 more a month. Those on standard variable rate mortgages will see a £59 increase.

It means tracker mortgage holders could be paying about £167 more a month compared with pre-December 2021, with variable mortgage holders paying up to £132 more. Interest rates have risen six times in a row since the end of last year.

Higher interest rates also mean higher charges on things like credit cards, bank loans and car loans.