A lack of capacity to process crude oil has helped to drive fuel prices to record levels

Image source, Getty Images

Image source, Getty ImagesOil refineries are making nearly five times as much money from refining petrol as they did year ago, data show.

A lack of capacity to refine petrol and diesel from crude oil has helped to push fuel prices to record levels, and increased profits for refinery owners.

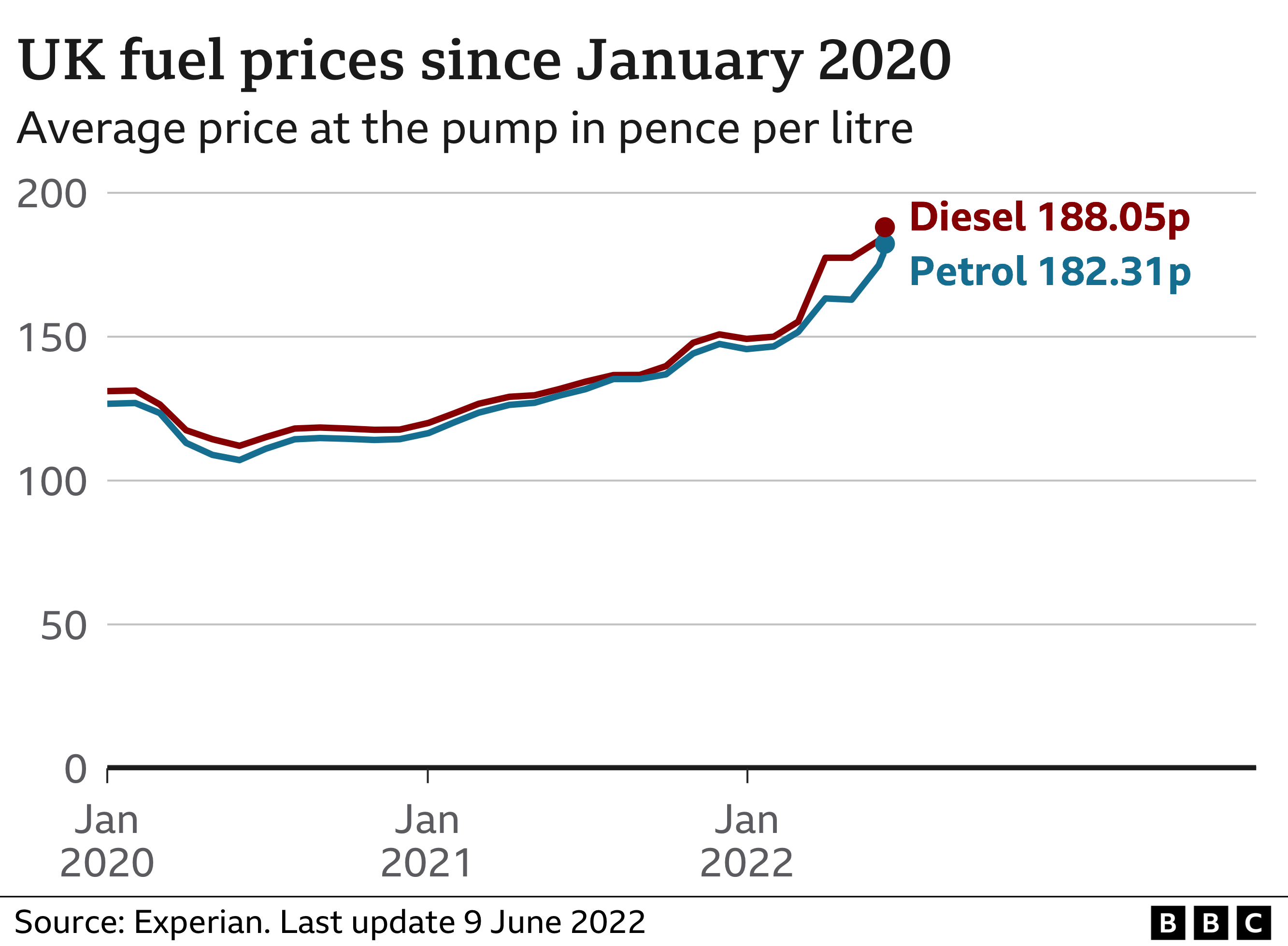

Petrol prices are at an all-time high though the oil price remains well below record levels.

The loss of Russian supplies has stretched an industry which was already at full capacity.

Tuesday saw the fastest rise in petrol prices for 17 years, and the cost of filling a typical family car has now passed £100 for the first time, piling costs on motorists.

On Thursday, the price of both petrol and diesel rose by nearly a penny a litre, the RAC said, with petrol at 183.16p a litre and diesel at 188.82p.

Part of the increase is down to the high price of crude oil, which is currently above $120 per barrel, driven up by fears the war in Ukraine would cut access to supplies from Russia.

That has led to billions of pounds of extra profit for oil producers, and led the UK government to impose a £5bn windfall tax on North Sea oil producers.

But oil refiners – the companies which turn crude oil into diesel, petrol and other products – are seeing their profits rise substantially too.

“The refiners are printing money at the moment,” says Neil Crosby, senior analyst at the data firm OilX. “More than they have ever witnessed.”

There’s a shortage of refining capacity, which has led to substantial increase in the “refining margin” – the difference between what they pay for crude oil and what they can make selling the refined products.

“This is a real crunch in terms of the industry’s ability to produce these fuels. That very much turns up in the wholesale price of diesel and petrol,” says Mr Crosby.

And that’s contributed to the fact that although oil prices are still some way off record highs, petrol and diesel have been setting new records day after day.

Image source, Getty Images

How much have margins increased?

Figures from the data company Refinitiv show how the business of refining oil has become so profitable in the past year.

On the 8 June 2021, refiners were making $9.26 per barrel from refining petrol, and $6.84 per barrel refining diesel.

On Wednesday, they were making $43.11 on petrol, up 366%, and $51.13 on diesel, up 648%.

Figures published by BP, which owns a number of refineries in Europe and the US, shows its own measure of refining profits, the ‘Refining Marker Margin’, up from $7.7 dollars per barrel to $35.7 over the past year.

US oil giant ExxonMobil owns a number of refineries, including Fawley in Hampshire, the UK’s largest. Last month the Financial Times quoted its chief executive Darren Woods as saying he did not think that the “very, very high margin environment” was “good for economies around the world.”

A source close to a major refinery owner argued that the refiners don’t set the margins themselves. Prices for crude oil, petrol and diesel are determined by the market – what supplies are available, and how much buyers will pay.

Why are refinery margins so high?

Before the invasion of Ukraine, much of Europe’s petrol and diesel supply was made in Russian refineries and imported in tankers. In 2020 the UK received 18% of its diesel supply from Russia.

Though that supply has not been cut off completely, the volumes coming from Russia are significantly lower as buyers shun Russian exports even before sanctions fully kick in.

Fuel stocks were low before the invasion and there was already a global shortage of refining capacity. The sector has not been highly profitable in recent years and attracted little investment.

So there was no slack to make up for lost Russian refining capacity.

The worldwide lack of refining capability has contributed to high fuel prices in other countries, including the US.

In addition, China has cut its exports of refined fuels. And although the UK doesn’t import directly from China, this has a knock-on effect on the entire global market, Mr Crosby says.

ExxonMobil did not respond to request for comment. BP declined to comment.