Consumer group Which? has written to the Treasury calling for urgent action to protect access to cash.

Image source, Getty Images

People who rely on face-to-face banking and cash are at risk of “being cut adrift” as branches and ATMs close, according to consumer group Which?.

Its analysis suggests that branches have been shutting at a faster rate in rural areas than in urban ones.

Which? has joined up with other consumer and business groups to call on the government to legislate soon on protecting access to cash.

The Treasury said it recognises cash remains “vital” to millions of people.

The consumer group wrote a letter to the Treasury on Monday calling for urgent action.

“With rising living costs placing additional pressure on people’s personal finances, the consequences of being unable to withdraw cash for those consumers who already rely on it could be significant,” it said.

“Unless legislation is introduced urgently, the ability to access, spend and deposit cash could be permanently lost for many consumers, leaving some of society’s most disadvantaged at risk of financial exclusion with no way to pay for the goods and services they need in their daily lives.”

It is also backed by other organisations such as Age UK, StepChange Debt Charity, the British Retail Consortium, the Money and Mental Health Policy Institute, and the Federation of Small Businesses (FSB).

The national chair of the FSB, Martin McTague, who sits on the Access to Cash Pilots Board, said that the upcoming Queen’s Speech next month was the “last chance saloon where protecting access to cash is concerned”.

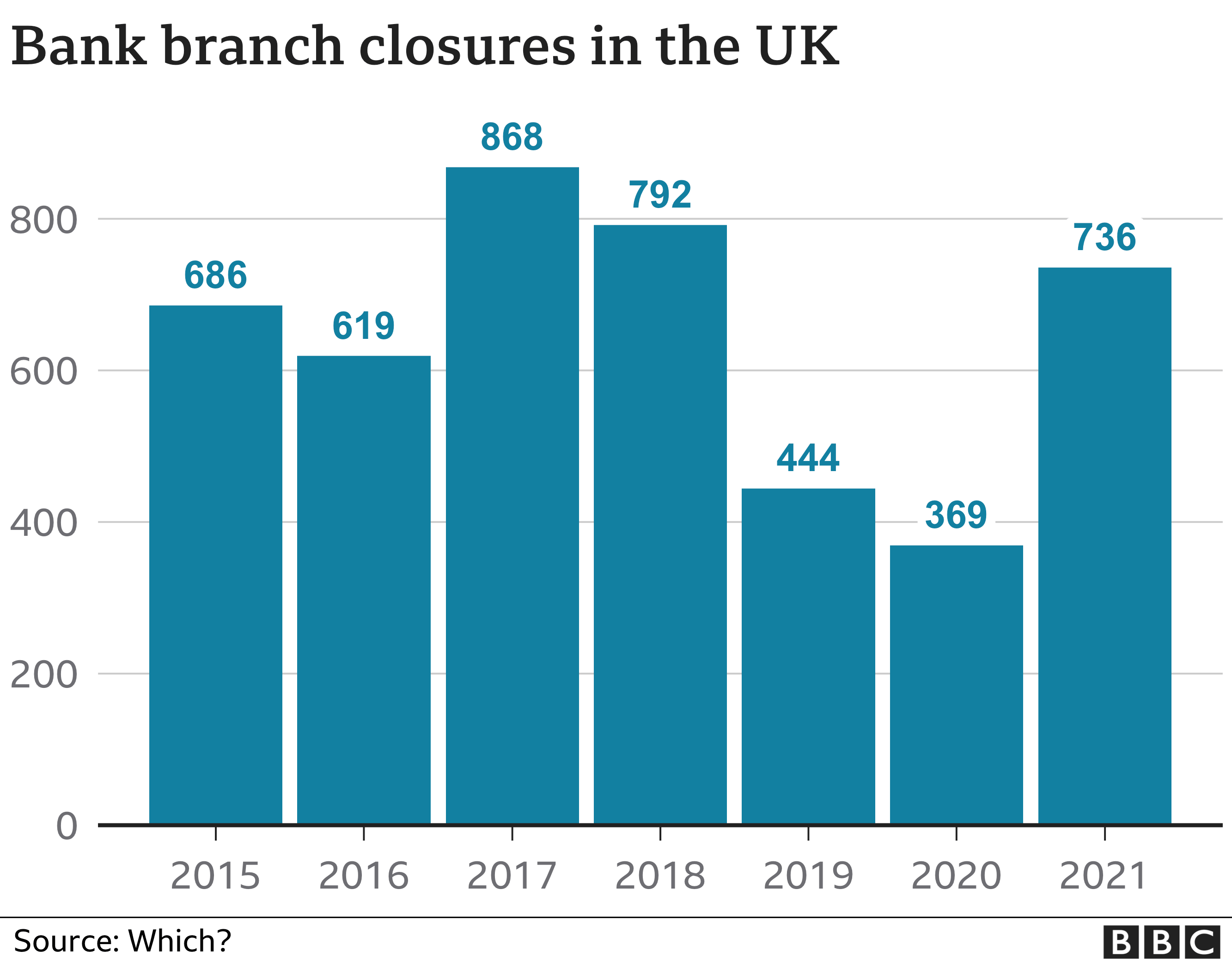

Which?’s new analysis suggested that since 2015, 4,685 bank branches have shut their doors.

A further 226 are already scheduled to close by the end of the year, it said, while the rate of closures in rural areas has outstripped those in urban areas.

Since 2015, the banking network in rural constituencies has been cut by half (50.7%), compared with 47.3% in urban areas.

It also identified 17 parliamentary constituencies that have particularly poor access to cash – with three or fewer bank branches and 30 or fewer free-to-use ATMs.

People aged 65 and over make up about a quarter on average of the population across those 17 areas that Which? said have poor access to cash.

Carmarthen East and Dinefwr in Wales, for example, have lost 13 out of 15 bank branches since 2015, and have a relatively high proportion of elderly residents.

According to recent statistics from the UK’s Financial Conduct Authority, most people do have reasonable access to cash through a combination of bank, building society or Post Office branches and ATMs.

But it did find that people in rural areas have to travel further on average to deposit or withdraw cash.

Access for vulnerable people

Although fewer people are strictly using cash, those who do tend to be from more vulnerable backgrounds, older or have very low incomes.

John Howells, the boss of the free-to-use ATM network Link, said: “While cash usage has fallen by around 40% since the start of the pandemic, millions of consumers including some of the most vulnerable still rely on cash every day.

“Link believes that consumers in every community across the UK should have free access to cash and works with the industry to maintain it.”

Late last year, the Access to Cash Action Group also set out plans on how the industry could ensure access for those most vulnerable people.

Suggested solutions included shared bank hubs, free ATMs, as well as shops offering cashback without purchases.

A Treasury spokesperson said: “We know that cash remains vital for millions of people and we are committed to protecting access to cash across the UK.

“That’s why we have consulted on plans for new laws to make sure people only need to travel a reasonable distance to pay in or take out cash, and have already legislated to enable shops to offer cashback to customers without them having to make a purchase.”

The spokesperson added that the Treasury would set out plans “in due course” following the consultation.

-

- 15 December 2021