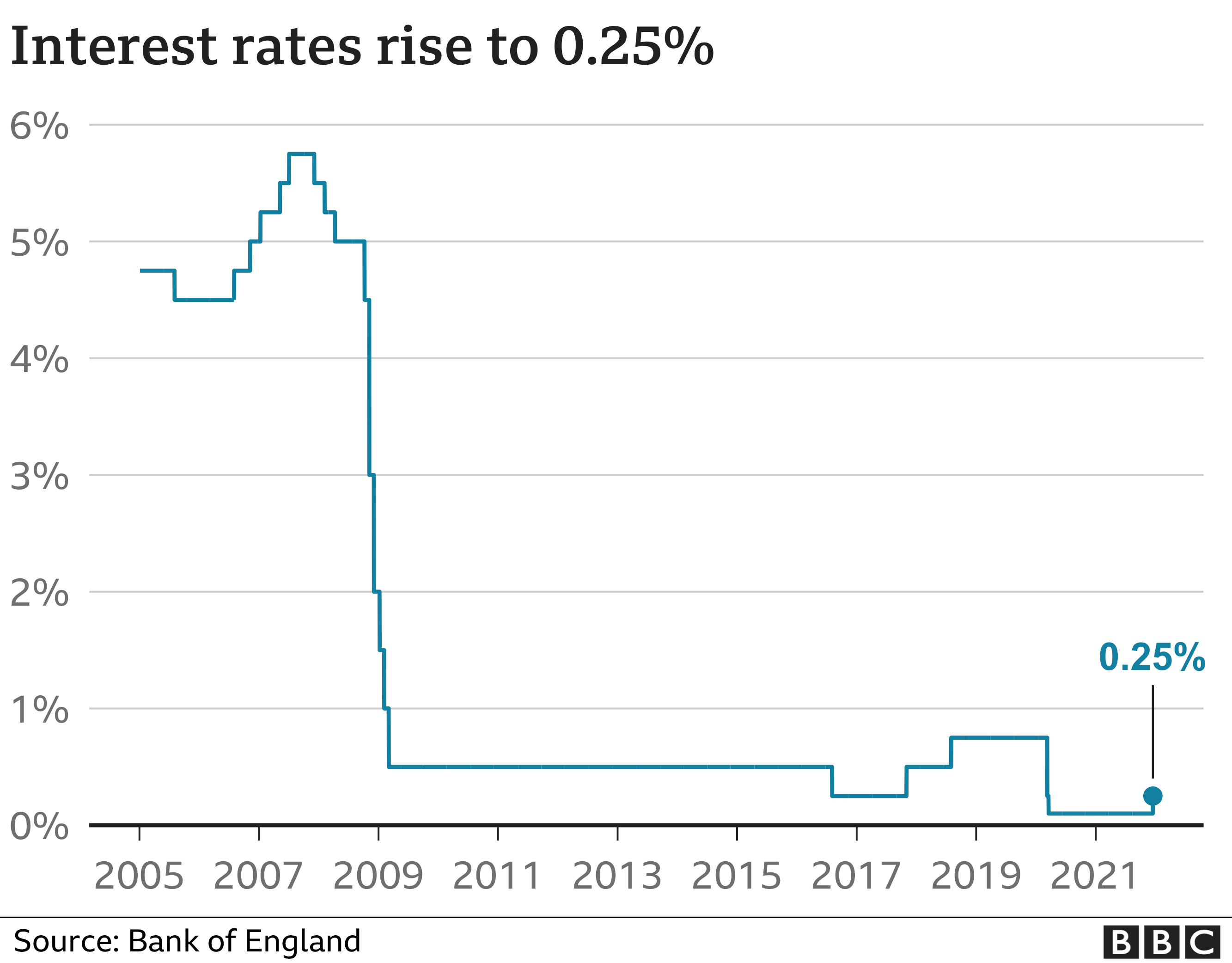

Policymakers increase rates from their historic low despite fears that Omicron could slow the economy.

Image source, Reuters

The Bank of England has raised interest rates for the first time in more than three years, in response to calls to tackle surging price rises.

The Monetary Policy Committee voted 8-1 in favour of the increase to 0.25%.

Rates were cut to a record low of 0.1% in March last year in response to the effects of the coronavirus pandemic.

The increase came despite fears that the Omicron variant of Covid could slow the UK economy by causing people to spend less.

The decision by the Bank of England to increase the base rate to 0.25% will add just over £15 to the typical monthly repayment for a tracker mortgage customer.

A standard variable rate mortgage-holder is likely to pay nearly £10 extra a month.

Nearly two million people in the UK have one of these two types of mortgage.

While savings rates may increase slightly, returns are still well below the rate of inflation.

According to official figures, the cost of living surged by 5.1% in the 12 months to November, up from 4.2% the month before, and its highest level since September 2011.

The Bank can raise interest rates to help control price rises – but many experts had expected it to hold off because of uncertainty about Omicron.

Yet on Thursday it said the prices of global assets, such as stocks and bonds, had largely recovered after an initial fall in response to news of the new variant.

Successive waves of Covid also appeared to have had less impact on economic growth, the Bank added, although there was uncertainty around the extent to which that would prove to be the case this time.

“Consumer price inflation in advanced economies has risen by more than expected,” it added.

“The Omicron variant poses downside risks to activity in early 2022, although the balance of its effects on demand and supply, and hence on medium-term global inflationary pressures, is unclear.”

Only one MPC member, Silvana Tenreyro, voted to hold rates at 0.1%.

It was the second month in a row that Bank policymakers had surprised the markets.

Economists had expected a rate rise at the MPC’s last meeting in November, but policymakers voted to hold fire.

This time, analysts expected a further delay because of Omicron, but the committee thought differently.

“The Bank of England’s decision to raise interest rates was surprising, given mounting uncertainty over the economic impact of the Omicron variant,” said Suren Thiru, head of economics at the British Chambers of Commerce.

“While today’s rate increase may have little effect on most firms, many will view this as the first step in a longer policy movement – not as a partial reversal of last year’s cut.”

He added that the current inflationary spike was mostly driven by global factors, so higher interest rates would do little to curb further increases in inflation.

Instead, the government needed to find practical solutions to the UK’s supply chain problems and labour shortages, he said.

The Monetary Policy Committee also voted unanimously to maintain the Bank’s asset purchase scheme at £875bn.

The last time the Bank raised interest rates was in August 2018, when they reached 0.75%.

They were then cut twice in March 2020 at the start of the pandemic.