But retailers say it could take months to update terminals so people can spend up to £100 without a Pin.

Image source, Getty Images

The spending limit on each use of a contactless card has now risen from £45 to £100 – but not every shop will accept the new payment threshold.

Retailers say it could take months to update terminals before every shopper can spend up to £100, without the need to enter a four-digit Pin.

The move aims to make purchases such as grocery shopping more convenient.

But some warn it could lead to a rise in theft and one bank boss questioned whether shoppers want a higher limit.

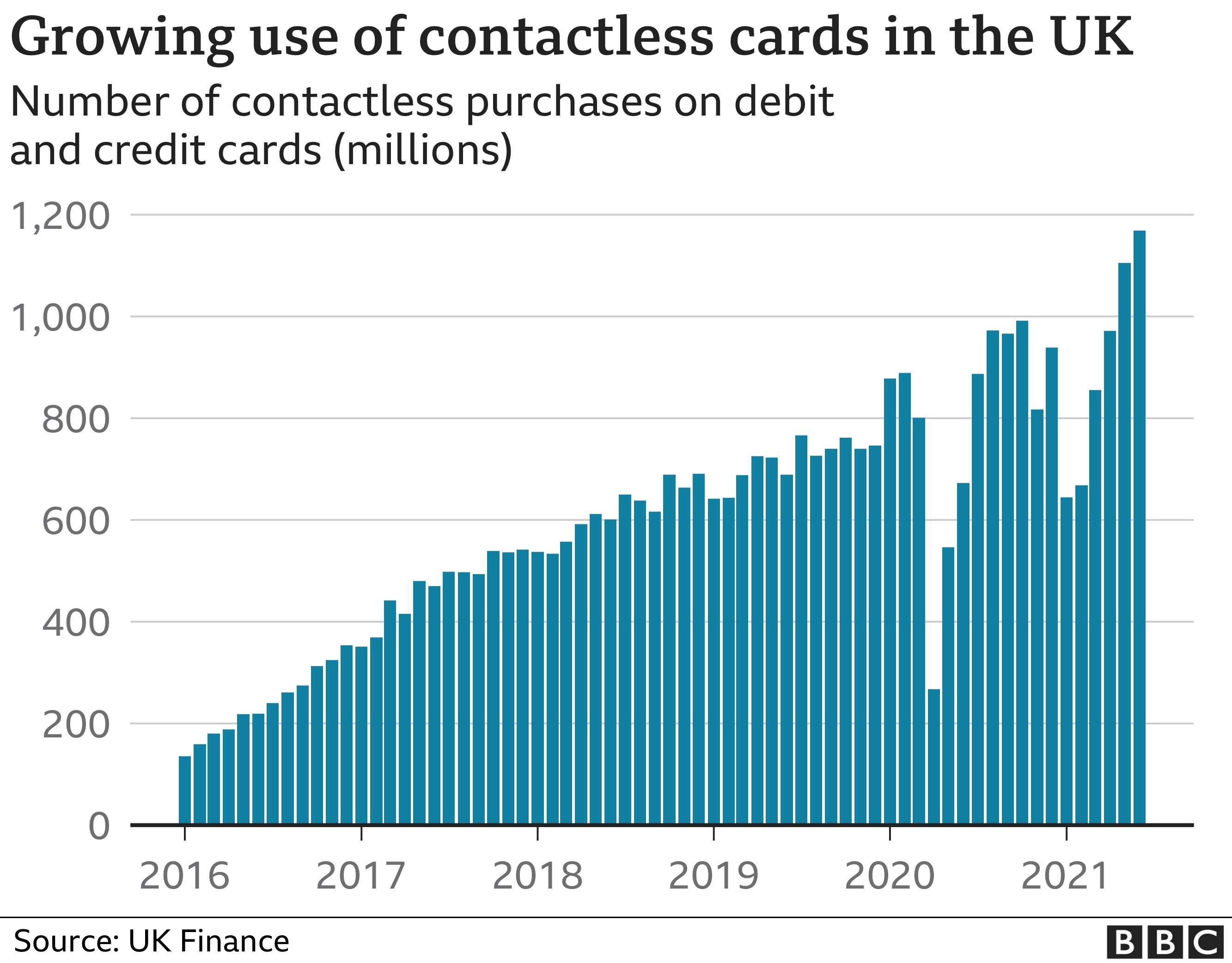

Some 60% of debit and credit card transactions in the UK were contactless in the first seven months of the year. These accounted for a total of 6.6 billion payments with a value of £81bn.

The decision to increase the threshold was taken by the Treasury and the City regulator, the Financial Conduct Authority (FCA). Chancellor Rishi Sunak said the decision would bring convenience for shoppers and a boost to the High Street following Covid lockdowns.

When contactless card payments were introduced in 2007, the transaction limit was set at £10 and designed as an alternative to small change.

The limit was raised gradually, to £15 in 2010, to £20 in 2012, and then to £30 in 2015. It was hurriedly increased to £45 last year as the pandemic accelerated a move away from cash.

As the limit has increased, so has the frequency of its use. Despite sudden drops of all transactions during national lockdowns, the general trend has been continuing growth. That has come as consumers have been less likely to use banknotes and coins.

The huge number of terminals which need to be updated means that Friday marks the first day of a gradual introduction of the new limit.

“It may take days, weeks, or even months for some retailers to make the necessary changes in their systems so that the new limit can take effect,” said Andrew Cregan, payments policy adviser at the British Retail Consortium.

“Furthermore, some retailers may choose not to adopt the new contactless limit. As a result, customers will need to take care when making payments to check what the maximum contactless limit is for individual stores.”

Campaigners have been concerned that as card and digital payments become more prevalent, it could affect access to cash for those who still rely on it.

FCA research found that a greater proportion of consumers were finding it difficult to cope with fewer retailers accepting cash during the pandemic. However, it found that eight out of 10 small and medium-sized businesses said they were “very likely” to accept cash over the next five years.

Graham Farrell, professor of crime science at the University of Leeds, has warned about the “huge increase” in attractiveness of bag snatches and pickpocketing by teenage thieves, who could then spend more on a stolen card.

He co-authored a paper pointing out that these young criminals could then go on to long-term criminal careers.

A thief will now be able to spend more on an unreported stolen card before a Pin is demanded. FCA guidance suggests a cumulative £300 needs to be spent on contactless before a purchase is checked by a Pin, up from the previous recommended level of £130.

Prof Farrell told the BBC a halfway house was needed.

“A solution that would balance both sides would be tap-and-Pin. You would have contactless tapping of the card on a machine, without the trouble of putting it in and out of the machine. You would use Pin codes to ensure security, therefore making the theft of the card – as the thieves do not have the Pin – less attractive,” he said.

Authorities have sought to allay any concerns about an increase in fraud, pointing out that there was no rise in the crime after the last increase in the payment limit.

“What’s more, we have seen no material increase in fraudulent transactions in other countries where the contactless limit increased to the equivalent of £100 or above,” a spokesman for the FCA said.

Australia and Singapore have contactless limits of the equivalent of about £100, and Canada’s is close to £150.

Customers of a variety of banks can switch off the contactless function, or request a non-contactless card.

Some – notably Lloyds Banking Group and Starling – will allow customers to set their own contactless limit via the banks’ apps.

Anne Boden, chief executive of Starling Bank, questioned whether consumers really wanted to be able to spend more on Pin-free transactions.

“Analysing our spending data we can see that there appears to be little demand for the increased contactless limit and that many would like to retain the same contactless limit or even reduce it,” she said.

Shoppers can spend more than £100 without a Pin using payment services on smartphones, although they include in-built security on the devices such as fingerprint authorisation.