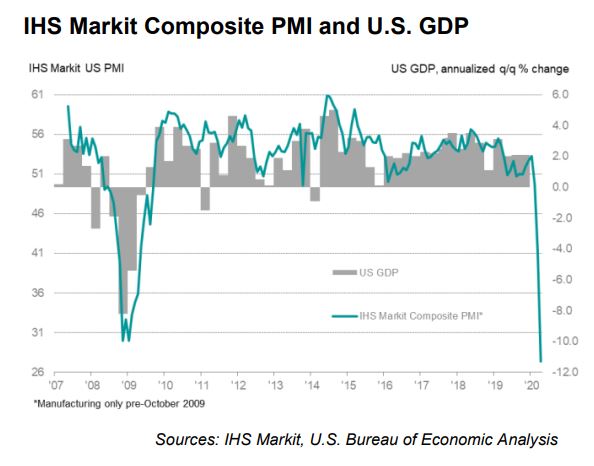

The numbers: The IHS Market flash purchasing managers index for the service sector fell to a record low in April, while the manufacturing PMI weakened to the lowest level in 11 years, as business activity has slumped due to the lockdowns to combat the coronavirus pandemic.

The flash services PMI fell to 27 from 39.8 in March while the manufacturing PMI dropped to 36.9 from 48.5.

Any reading below 50 indicates worsening conditions. The “flash” reading is based on approximately 85% of the final number of replies received each month.

What happened: The cancellation of orders has led firms to reduce their workforces at the start of the second quarter. Input prices have dropped at the fastest pace on record. Business confidence turned pessimistic for the first time since the series was started in 2012.

Overseas readings were also terrible. The flash eurozone services PMI slumped to a record low 11.7 in April, with Germany’s services PMI skidding to 15.9.

Flash US PMI collapses to record low in April (27.4; Mar – 40.9) to signal a severe downturn in output comparable with the depths of the financial crisis. Both manufacturing and services touch historical lows amid COVID-19. More: http://ihsmark.it/uIlj50zmrvC

What IHS Markit said: “The scale of the fall in the PMI adds to signs the second quarter will see an historically dramatic contraction in the economy, and will add to worries about the ultimate costs of the fight against the pandemic,” said Chris Williamson, chief business economist at IHS Markit.

Big picture: The coronavirus shutdown has led to a sharp business contraction across the country. The services sector can normally hold its own during a recession, but the social distancing put in place to combat the epidemic has decimated the sector. All signs point to a deepening recession as claims for unemployment benefits now total above 26 million.

Market reaction: U.S. equity benchmarks opened higher on Thursday. The S&P 500 SPX, 1.31% index was up 23 points in early trading.

Originally Published on MarketWatch